Follow us on LinkedIn

Our PageIntroduction

A company car is a vehicle that employers provide to their employees. These vehicles are often sedans or standard-model SUVs, not specialized vehicles. Employees mostly use these cars to drive to and from work, or as transportation if they need to travel to perform their tasks. Salespeople, merchandisers, and field technicians tend to be the most common users of company cars, but many other professions use them, too.

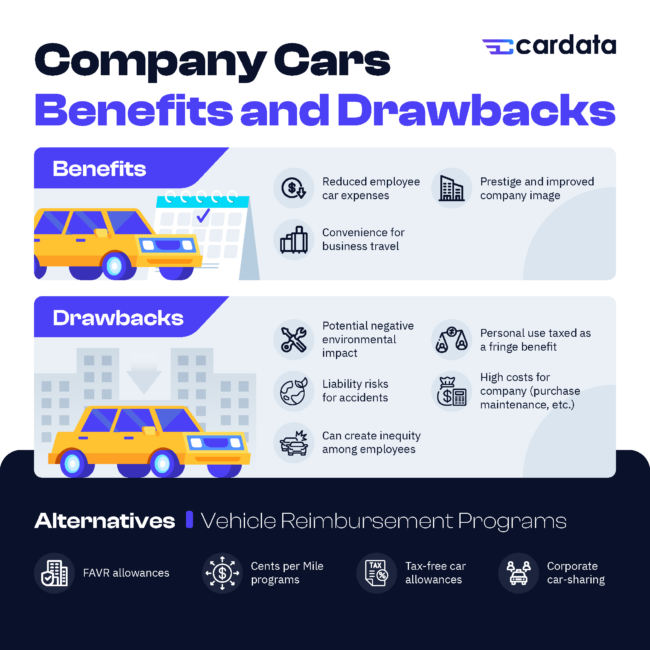

Company car benefits

Company cars provide a lot of advantages for both employers and employees:

Convenience

Employees that are assigned company cars have greater mobility. They can travel rapidly from one location to another without having to rely on public transit, which is slow and not as efficient.

Company cars also allow employees greater flexibility while traveling, because they can choose their own route. For example, a sales person with a company car can visit several customer sites in a single trip if they plan their route properly. They can also use company cars to travel between their homes and the office.

Company perk

It is not every day you get offered a car with your job. Company cars can attract and help to retain sales talent. Realistically speaking, a business might only be able to afford to give company cars to a select few employees. This makes them highly coveted perks that can boost the morale of those that receive one, and motivate others to perform better in order to qualify.

Less insurance liability for employees

Using a company car is less liability, from an insurance perspective, for employees because the company owns, insures, and takes responsibility for the vehicle. If the driver gets involved in an accident, the company’s fleet insurance could end up covering the damages.

It should be noted that a vehicle reimbursement program (VRP) can protect the driver from risk, too—even if they’re using their own personal vehicle. Their company reimbursement will cover their insurance payments, and employees can source very robust insurance policies, like 100/300/100. So, they are amply protected, even on VRPs.

Lower vehicle expenses

Driving a company car means that the employee doesn’t have to pay for gas, maintenance, and vehicle insurance. And remember, they’re using a vehicle that they didn’t even have to buy or rent themselves.

However, they do have to pay personal use chargebacks. A personal use chargeback is a payment that employees make to their company for the personal use of the business vehicle. Moreover, personal use of a business vehicle is considered a taxable benefit, so companies have to make sure that taxes are accounted for on company car programs.

A company car may be a great cost saving for employees, but it’s not the only way to lower an employee’s vehicle expenses. With a VRP, the employee gets reimbursed for gas and has additional insurance coverage for when they use their personal vehicle on the job.

On the flip side, a VRP means a company doesn’t have to pay for a vehicle up front. They just help cover an employee’s costs whenever they use their own vehicle for business purposes. It’s a compromise that benefits both sides.

Read more: Benefits and Drawbacks of Company Cars | Cardata

Corporate car programs

When a company owns a group of motor vehicles, that’s called a fleet. A corporate car fleet is composed of regular vehicles that are used mostly for transportation, and can run anywhere from a couple of cars to a thousand—depending on how big the company is and what they’re being used for.

This represents a significant capital investment, even for large enterprises. Sometimes a company doesn’t want or can’t afford to own corporate fleet vehicles. So these businesses build an outsourced fleet by leasing vehicles for a fixed period instead.

This allows them to provide company cars without the financial burden of purchasing a vehicle outright. This works best when leasing regular cars like sedans, SUVs, and pickups instead of specialized vehicles.

There are corporate car lease programs that specialize in business vehicle leasing on either a short-term and long-term basis. Companies use these for various purposes, such as business trips, temporary assignments, or as a substitute for company cars.

Managing and maintaining all those vehicles can be a challenge, however, even if they’re all leased. That’s why the best corporate car rental programs provide a range of secondary services to help companies keep their fleet running. Examples of these packaged services include maintenance and repair, fuel supply and management, and insurance. This is similar to what fleet management companies do, but not exactly the same.

Company car vs. car allowance

While a company car program does have some solid benefits, it is not the only way to run a fleet.

One alternative is giving employees a car allowance. A car allowance is a fixed monthly payment given to employees to cover work-related driving expenses when they use their own vehicle. The allowance is usually deposited straight into their bank accounts, and can be a taxable employee benefit or a tax-free vehicle reimbursement program.

Many companies opt to provide car allowances rather than actual company-owned or -leased vehicles. Here are a few reasons why:

The employee gets to choose the car. Company-run fleets aren’t always big enough to let employees pick a vehicle. So if they get assigned a model they don’t like, or get the “old” vehicle in the lot that doesn’t run as well, then they’re stuck with it.

A car allowance program, however, lets them use their own vehicle, which is more comfortable for the employee and will likely cause fewer complaints.

It’s just as convenient. The employee enjoys the convenience, flexibility, and mobility of having a vehicle to use for work—regardless of whether it’s theirs or the company’s. Businesses, for their part, can be confident that their employees can get to where they need to go safely and dependably.

The company saves money. In a car allowance program, companies don’t have to invest money acquiring a fleet of vehicles, whether that’s via rental or direct purchase. Nor does the company have to spend money on vehicle maintenance: no crews, no tools, and no facilities necessary. The employee just maintains their own car.

Less company liability. When an employee is given a fleet car, the company is still liable for it even after the employee goes home. So if they get into an accident off-the-clock, the company will still have to cover the damages.

In a car allowance program, the company is only liable for anything that happens during work hours. The company’s responsibility ends once the employee goes home.

Read more: Company Cars and car allowances: Which works for you? | Cardata

Insuring your company car

Any vehicle a company uses must be insured (it’s the law), but a business has a few different options to choose from. Two of the most popular kinds of insurance are commercial fleet insurance and business car insurance. While the two sound very similar on the surface, there are distinct differences in how they work and when they should be used.

Commercial fleet insurance

Commercial fleet insurance is similar to standard auto insurance, but covers a fleet of multiple vehicles instead of a single car. The vehicles in these fleets can vary from regular cars and vans to special-purpose freight trucks, school buses, and ambulances. Fleet sizes can also vary: many insurance companies tier their plans based on how many vehicles are being insured and what type they are.

Commercial fleet insurance tends to be higher than standard personal insurance plans because the vehicles are going to be more heavily used than personal vehicles. That increases the overall risk considerably, and affects both rates and liability limits. The purpose of the intended vehicle can also affect the rate. For example, trucks carrying hazardous materials are going to have higher fleet insurance premiums than a fleet of taxi cabs.

Other factors that affect the price are the driving history of whoever’s using the vehicle, the location of the business, and the amount of coverage chosen. It’s not unheard of for vehicle insurance to cost upwards of $2,000 to $3,000 per vehicle a year for small fleets, and $3,000 to $4,000 a year for large fleets.

Read more in the Newsletter: What Factors Affect Car Insurance Premiums?

Business car insurance

While fleet vehicle insurance is meant to cover vehicles of nearly any type and purpose, business car insurance has a more limited scope. Business car insurance is designed to cover vehicles used primarily for business purposes—meaning transporting goods, traveling to and from the office and meetings, and providing client services. This makes it the ideal choice for fleets comprising mostly sedans and similar vehicles.

Like commercial fleet insurance, business car insurance is more expensive than personal car insurance. Again, this due to business vehicles being used more often and, depending on the task, being exposed to greater risk. As such, business car insurance plans tend to cover things like property damage liability, vandalism, lost equipment, theft, rental cars, and employee injuries. Typical plans include collision, liability, and comprehensive coverage.

One major difference between business car insurance and fleet insurance is “business use endorsement.” This is an add-on to an existing personal auto insurance policy that provides coverage for both business use of the vehicle as well as personal. These are used whenever an employee uses their personal vehicle to do work-related tasks. It’s a cheaper alternative to fleet insurance (not to mention it saves the company money on actual vehicle expenses), but doesn’t provide the same level of coverage.

This business use endorsement can be used when using Fixed and Variable Rate (FAVR) reimbursement programs, which are essentially employee-owned fleets.

Read more: Finding the best type of insurance for your company cars | Cardata

Company cars and taxes

Taxes are an important but often-overlooked aspect of managing a fleet. Businesses should carefully review and understand the tax rules before building a fleet, as this may affect how it will be set up. Moreover, it is important to consult your internal accounting department or your tax advisor for the best and most up to date information on company car taxes.

Understanding tax exemptions, deductibles, and other rules related to company cars can be challenging. Personal use of a company car is generally considered a taxable benefit and must be included in the employee’s income, with taxes withheld from each paycheck. However, exceptions and special rules exist based on factors such as vehicle type, business use, and government regulations.

The IRS provides various valuation rules for calculating the personal use of a company car. These include the general valuation rule, special valuation rule for employees with disabilities, lease value rule, cents per mile rule, and commuting rule. Employers must keep accurate records of expenses and report taxable benefits on employees’ W-2 forms, at least once per year.

In Canada, the Canada Revenue Agency (CRA) has its own tax rules for company cars. Employers must calculate the value of personal use and include it in employees’ income for tax purposes. They should keep accurate records and allocate expenses between business and personal use based on kilometers driven. Reporting taxable benefits on employees’ T4 slips and remitting payroll deductions to the CRA is also required.

Businesses in both the U.S. and Canada can take advantage of tax incentives and deductions when purchasing electric vehicles primarily for company use. These incentives aim to reduce the overall cost of ownership while promoting sustainable transportation options. Specific federal and provincial tax credits and deductions are available for businesses using electric vehicles.

Read more: Company cars and fringe benefit tax rules | Cardata

Business vehicle financing

Acquiring a fleet can be as simple as picking vehicles from a catalog and wiring the money over to the dealer, but most businesses don’t have that kind of capital lying around. Paying vehicles in full doesn’t make financial sense for startups and small businesses, and even larger corporations have better things to do with their money. The down payments alone can eat up a large part of a business’ cash flow—money that could be spent on hiring staff, increasing production, advertisements, or any other revenue-generating activity.

Granted, there are some benefits to paying in full. It’s cheaper in the long run, as businesses won’t have to deal with interest rates or fees. Businesses also have the freedom to do whatever they want with the vehicle since it’s fully paid off.

Generally, however, paying in full uses up a lot of cash in one go—even for small fleets. Vehicles also depreciate quickly, so it will be worth less to the business and a bigger cost as maintenance and repairs pile up, but all the taxes will have been paid at full value right away.

Many businesses opt to finance their vehicle fleet purchases instead. Lenders typically require businesses to provide financial statements and other documentation to prove that they’re good loan candidates. Businesses will also look at cash flow, how long the business has been in operation, and what industry the business is in.

Businesses can improve their chances of getting their credit approved by maintaining a good credit score and paying their bills on time, managing their debt responsibly, and limiting the number of credit applications they submit.

Many financial institutions have a variety of loan packages specifically for businesses, so the company will be able to shop around before settling on a lender.

Financing a fleet involves special tax considerations. A fleet vehicle may qualify for what is called a “depreciation deduction,” where a portion of the vehicle’s value is dedicated from the taxes of each year. The cost of financing charges and other expenses related to the car’s purchase can also be deducted.

Read more: Company cars: best financing options in 2023 | Cardata

Company car policy

Whether a business buys their fleet, leases it, or has employees bring their own vehicles, people are still driving around on company business and on company time. Thus, it behooves a business to establish a set of guidelines or rules for the usage, maintenance, and appearance of these vehicles.

Here are some recommendations for what a company car policy should cover:

Vehicle appearance

A company car is a highly visible ambassador of a company’s brand—even if it doesn’t have any actual livery. As such, company vehicles have to be kept clean both inside and out. It should be in good working order and free of visual imperfections and damage to help maintain the company’s sterling brand image.

Read more: How you can use vehicle policies to maintain brand standards

Driving and road safety

Company car policy should mandate safe and defensive driving practices for all employees using company vehicles. This isn’t just for the brand image; it’s to keep employees safe from harm, keep company property undamaged and in good condition, and it helps keep insurance costs low.

Make sure employees understand what defines good driving, too. The policy should specify how to park properly (no double parking), obeying speed limits and traffic signs, no phones while driving, and what to do in case of an emergency.

Driver dress codes

If the company has a dress code, then it is just as important to follow it while using a company car as it is in the office. Uniforms should always be worn properly and with ID’s clearly displayed to prevent misrepresentation of the brand—especially if drivers come into regular contact with customers or the public.

Company stickers on personal vehicles

Some companies that use a VRP ask employees to attach brand stickers to their personal vehicles as a way of promoting the company. Note that employees don’t have to do this. It’s the employee’s right to accept or deny this request because their vehicle is not company property.

If the employee does allow the company to brand their vehicle, then it has to be professionally applied at the company’s expense. This is so that the branding can be correctly applied, and so that the employee isn’t paying for something they shouldn’t.

Read more: Creating an Effective Car Allowance Policy in 2023 | Cardata

Company car alternatives

Purchasing or leasing a company car isn’t the only way a business can provide vehicles to their employees. There are a range of other options available, each with their pros and cons.

FAVR

A fixed and variable reimbursement (FAVR) program is a type of vehicle reimbursement program. In it, employees use their own vehicles to perform company tasks, and the company reimburses them for any fixed and variable costs like fuel, tolls, taxes, and insurance. These reimbursement rates are calculated using IRS guidelines and adjusted depending on geographical location.

FAVR programs are more affordable for employers, since they’re not buying or leasing a fleet. The company pays for the actual business use of operating a vehicle, and not the overhead costs of storage and maintenance. FAVR also reduces company liability by sharing it with the employee.

Read more: Fixed and Variable Rate (FAVR) Reimbursement Guide

Car allowances

Car allowances are another popular vehicle reimbursement program. In this kind of program, companies give employees the money to lease or purchase a new vehicle. The allowance is tax-free up to a certain amount, and can be adjusted based on the individual’s seniority, duties, and distance of travel.

Car allowances are designed to help employees cover the costs of owning and maintaining a vehicle—not getting a new one. This means that they are better than IRS standard-rate programs that can overpay high-mileage drivers. That said, it’s still a good perk and allows both the company and the employee greater flexibility and cost savings.

Check out Tax-Free Car Allowances: Tax-Free Car Allowance (“TFCA”) | Cardata

Corporate car-sharing services

Car-sharing is a membership-based service where a company provides access to vehicles for a fee. These vehicles are parked in convenient locations across a city. Members book a vehicle, go to the pickup location, and unlock it with a card or code. When they’re done, they can return it to any location run by the car-sharing company.

This may be a viable option for businesses that don’t need a company vehicle all the time, or if they can’t afford to own and maintain their own fleet. They simply sign up for a corporate membership (monthly or annual) and list their employees as dependents.

Company car cost analysis

It can be a challenge for businesses to figure out how much they’re actually spending on a fleet. Each vehicle represents a slew of acquisition, operational, and administrative costs that have to be tracked singly and collectively.

Acquisition costs

The cost of acquiring a car can vary wildly, even within the same brand, category, and model year. Everything affects the cost—the trim, the engine size, and even the kind of key being supplied (remote starter fob or just a basic key).

The business also has to consider how much it costs to acquire the vehicle, both in the short- and long-term? Was the vehicle purchased outright in one big payment, or was it financed? If so, for how long and at what interest rate?

If it was leased, what are the terms of the lease? Is it an open-ended business car lease, or a closed-ended lease? Is there a mileage limit on each vehicle, and if so, how high is it? What are the penalties for going over that limit?

What about alternate means of acquiring vehicles? Well, the costs of using a car subscription service are relatively simple—just a monthly or annual fee. But FAVR programs have the lowest car acquisition costs of them all, because the employees provide the vehicles.

Operational costs

As you might expect, fleet operational costs grow the more vehicles a business operates. Consumables like fuel, wiper fluid, tires, and even some spare parts can be purchased and stocked in bulk. This can save some money, but only if all the vehicles in the fleet use the same consumables.

But someone needs to do the maintenance on the vehicles. This involves hiring a team to maintain and manage the fleet. It’s possible to do just basic upkeep with a very lean team, but the better maintained a fleet is, the more money it will save in the long run thanks to higher fuel efficiency and fewer breakdowns.

It’s possible to hire a third-party service to maintain those vehicles if the business can’t afford to hire people full-time. In fact, some fleet management companies can both supply and maintain the vehicles for a price. It’s up to the business to calculate whether or not that works out to be cheaper than running everything on their own.

Alternative fleet vehicle programs like car sharing and FAVR don’t have to worry about that. In FAVR’s case, the business pays a variable per-mile rate for fuel and maintenance. The employee will be the one maintaining their own vehicle, and getting reimbursed for it, so there’s no need for maintenance staff.

Administrative costs

Administrative costs are often overlooked when it comes to running fleets of company cars. Taxes, which we covered earlier, can be tricky based on how the vehicles were acquired and need careful review and management.

The same can be said of insurance. Company cars can be more expensive to insure than personally owned vehicles, and a business needs to shop around in order to get adequate coverage at a price they can afford.

Then you have other administrative considerations like how the vehicles will be assigned to employees, building and enforcing company car policies, actually managing company car inventory, and whatever other legal or liability issues that may crop up over the course of running the fleet (for example, a car accident). All that takes a dedicated person to oversee this aspect of fleet management.

FAVR programs don’t approach fleet administration the same way. While they don’t have to maintain a collection of company-owned cars, they do have to spend more time calculating vehicle reimbursements, managing insurance for employee-owned vehicles, and enforcing at-work driving policies—all of which still need a dedicated administrator. That’s one reason that so many companies choose to outsource their vehicle reimbursement programs.

Read more: Fleet Vehicles: What Do They Really Cost?

In conclusion

A company car fulfills a valuable need—it gets employees where they need to go, and it does so in a way that is timely, cost-efficient, and convenient. This is why many companies supply their employees with company vehicles despite the expense. By itself, a company car won’t generate revenue or fulfill company goals. But it helps the employees that do.

Businesses have a lot of choices on how they can acquire, operate, and manage company cars—with each method having their own pros and cons. From straight up purchasing a vehicle, to leasing, to having employees bring their own, there’s bound to be an arrangement that can fit any business of any size.

Disclaimer: Nothing in this blog post is legal, accounting, or insurance advice. Consult your lawyer, accountant, or insurance agent, and do not rely on the information contained herein for any business or personal financial or legal decision-making. While we strive to be as reliable as possible, we are neither lawyers nor accountants nor agents. For several citations of IRS publications on which we base our blog content ideas, please always consult this article: https://www.cardata.co/blog/irs-rules-for-mileage-reimbursements. For Cardata’s terms of service, go here: https://www.cardata.co/terms.

Share on: