Follow us on LinkedIn

Our PageIntroduction

For a long time, company cars have been a popular fringe benefit for employees required to drive for their line of work. The reign of the company car intensified after the Great Financial Crisis of 2008 when the Jobs Act began to offer more tax breaks for things like business vehicles.1 However, compared to the other options available, there are more cost-efficient ways for business owners to get their employees on the road – after all, getting a bang for one’s buck should be the number one valuation rule for companies. While the idea of having a new car provided by an employer for both business use and personal use may seem appealing, there are several pros and cons to consider when it comes to the question of automotive solutions. This article outlines precisely why that may be.

1 Tax Cuts and Jobs Act Expands Tax Breaks for Business Vehicles

Company cars: a prestigious benefit in kind?

The following reasons make company cars look like a great programmatic answer to the question of employees who need to amass business miles consistently.

Reduced employee car expenses: One of the most significant advantages of company cars is the financial burden it may offset for the privileged employees who use them. Once someone has access to a company fleet, they no longer have to pay for gas, maintenance, or insurance; this inevitably saves them a lot of time and money in the long term. However, the personal use of a company car does not reap those same benefits – mileage reimbursement does not count for driving unrelated to work. In other words, only business mileage can evade out-of-pocket payments.

Convenience: Having a vehicle for business use on hand is extremely convenient; it helps employees avoid the hassle of renting or buying a personal car or relying on public transportation for business travel, which can get quite messy depending on the location of the business.

Prestige: As a status symbol, having a company car can also boost an employee’s professional image and self-esteem; it shows that their employer values them and has a higher responsibility level within a larger organization. In a similar vein, providing company cars can significantly improve the image and reputation of the business, as well as increase brand awareness if employers choose to incorporate branding on the vehicles.

Drawbacks of company cars

While the pros of company car programs are rather exciting and seemingly good for business, it becomes less practical when we consider the cons.

- Costs: Providing company cars can quickly accumulate business expenses for the employer. The cost of purchasing and leasing the vehicles can be rather steep, but ongoing expenses include maintenance, repairs, insurance, and fuel. These costs can become challenging to manage, especially if the vehicles need to be tended to frequently.

- Carbon footprint: If the overseer of the vehicle initiative overlooks environmental impact, the employee could face a lot of undue stress about an issue that is entirely out of their hands. More specifically, if fuel-efficient cars are not used, and the company car program is inflexible, there isn’t much that can be done to offset their carbon footprint.2

- Liability: Companies that provide cars necessarily take on a certain amount of liability – for property damage and bodily injury. Suppose an employee is involved in an accident while driving a company car. In that case, the employer is typically responsible for any damages or injuries that result, even if the accident occurred due to personal use of the vehicle.

- Conflicts of interest: No doubt, prestige is tremendous, and so is boosting a worker’s sense of self-worth. But what if company cars are only for a select few? In this sense, providing company cars can create inequity among employees, as some may receive this benefit while others are forced to take transportation into their own hands.

- Taxable benefits: One major drawback of this kind of vehicle program is the company car taxes that can quickly reduce the amount on your next return. Sure, there are certain tax deductions available, but things can get complicated if careful attention isn’t paid. For example, when employees drive a car considered to be a business asset, they must follow the strict tax rules the IRS has in play regarding the personal use of a company vehicle, as this is considered a taxable fringe benefit.3 If they choose to take the company car home, this could add up to 25% of the value of the benefit. This means that the cost of the car is not just limited to the purchase price but also includes the taxes and fees associated with the benefit.

The value of this benefit must be calculated and reported as part of the employee’s taxable income and the vehicle’s fair market value, the number of personal miles driven, and the IRS mileage rate.

Employers must withhold taxes on the value of the fringe benefit and report it on the employee’s Form W-2. Additionally, the employee may need to make estimated tax payments to cover the tax liability associated with the personal use of the company vehicle.

There are, however, some exceptions to this rule, such as if the vehicle is used exclusively for business purposes or if the employee pays fair market value for the use of the car.

In short, both employers and employees need to understand the tax implications of using a company vehicle for personal use. You have to pay personal use taxes if you take the company car home, which could add up to 25% of the value of the benefit. Proper documentation and reporting can help avoid any issues with the IRS and ensure compliance with tax laws.

Proper documentation and reporting can help avoid any issues with the IRS and ensure compliance with tax laws.4

2 Fleets and the environment: Carbon offsetting schemes help green-minded fleets

3 Personal Use of a Company Vehicle

4 Your Guide to Navigating Through Personal Use of Company Car Rules

Vehicle reimbursement programs: a cost-efficient alternative

While there are benefits to providing company cars, there are also alternative options that companies can consider. One of these options is vehicle reimbursement programs (VRPs). VRPs are an excellent perk for employees, as they provide the same benefits as a company car without the added costs and risks to the company.

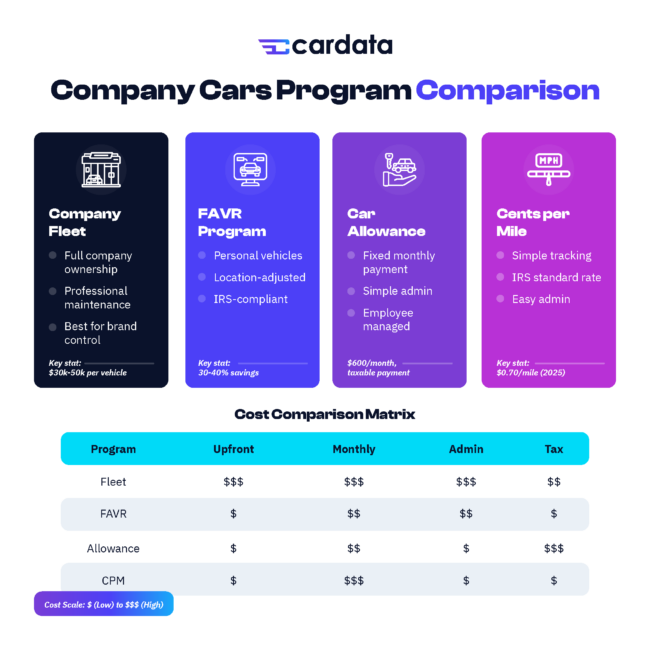

VRPs can be designed in several ways, including:

- FAVR car allowances: Fixed and variable rate allowances that are tax-free and cover vehicle expenses such as fuel, maintenance to counter depreciation, and insurance.

- Cents per Mile programs: Reimburse employees based on the mileage rate they drive for business purposes, as opposed to personal miles.

- Tax-free car allowances: Employees receive monthly reimbursements to cover vehicle expenses, which are tax-free as long as it covers vehicle usage for business purposes.

- Corporate car-sharing: Another alternative to providing company cars is using corporate car-sharing services. These services allow employees to access a pool of company-owned vehicles for business use without needing individual ownership.

Conclusion

Providing company cars can be a valuable benefit for employees, but it also comes with various costs and risks for the employer. Alternatives such as VRPs and corporate car-sharing services can provide the same benefits to employees without the added expenses and liability for the company. Ultimately, it is up to each employer to weigh the pros and cons and determine the type of vehicle program best suits their organization and employee needs.

Share on: