Follow us on LinkedIn

Our PageIntroduction

Whether it’s a new vehicle, a car allowance, a cash allowance, or another generous type of benefit in kind, most employers will do their best to offer something substantial to employees required to drive for work purposes. To be sure, each of these options has a distinct set of pros and cons – with that in mind, it’s imperative to understand their subtle nuances before deciding what works for your company.

Depending on the needs of employees and the type of business they are conducting on the road, one BIK may be more suitable than the others. In most cases, though, a car allowance is the superior choice—especially a tax-free car allowance. Nevertheless, the needs of different companies can be diverse, which is why this article will offer a brief rundown of everything you need to know about company vehicles and allowances.

Defining our terms

- Company car: This describes a vehicle that is owned or leased by an employer for the sole purpose of providing it to an employee for business and personal use, in most cases. The employer is responsible for the initial purchase or lease and ongoing running costs, including insurance, fuel, maintenance, and whatever other fees may be associated with the vehicle.

- Car allowance: In this scheme, fixed monthly payments are allotted to employees to cover the cost of driving their private vehicle for business purposes, ultimately serving as an alternative to company-owned or leased vehicles.1 The employee uses their own vehicle, pays for all the expenses, such as maintenance costs, and keeps any unused portion of the allowance. The employee has complete control over the type and condition of the vehicle – this means they can consider things lifestyle choices in their car selection.

1 Car allowance vs a company car: comparing tax, benefits & more

Company cars: advantages and disadvantages

Convenience and efficiency

The most glaring advantage of a company car is the barring of inconveniences. The hassle and expenses of owning a vehicle or the car leasing process – all those irritating bureaucratic contingencies that force workers to jump through many hoops are shouldered onto the employer. Moreover, the driver of a company car does not have to worry about things like depreciation and overall wear and tear, which means they can better enjoy the convenience and prestige of operating a new car, one that’s just for them – it’s a great way to make workers feel appreciated, an essential part of any healthy employer-employee dynamic.2

2 Recognition is a simple yet effective way to keep employees from quitting

Taxability

Even though company car programs may seem glamorous and prestigious, it is still considered a taxable benefit by the Canada Revenue Agency (CRA) and Internal Revenue Services (IRS)3. Essentially, this means that the employee must pay income tax on the value of the benefit, which is calculated based on the type of vehicle, purchase price or lease cost, operating cost, personal use availability, and the number of miles driven off the clock. It’s important to note that the taxable benefit can be significant, primarily if the employee drives frequently for personal reasons or has a high-income bracket.

3 Car Expenses and Benefits: A Tax Guide (2023) | PwC Canada

Flexibility

One major disadvantage of a company car is that it severely limits an employee’s choices regarding their mode of transportation. The vehicle the employer provides may not conform to the worker’s preferences regarding design, size, color, or features. Furthermore, the employee may be obligated to share the car with other colleagues or return it upon departure.

Car allowances: perks and drawbacks

The main advantage of a car allowance is that it gives the employee more freedom and autonomy in how they use their vehicle. Employees can select cars that suit their needs, preferences, and budget. Employees can also use their vehicle as they wish without having to calculate, report, or justify their mileage reimbursement to their employer.

Costliness

The main disadvantage of a car allowance is that it may only cover some of the costs associated with owning or leasing a vehicle. Depending on the amount of the allowance and the type of vehicle, the employee may have to pay out-of-pocket for some business expenses, such as car maintenance, repairs, car insurance, fuel costs, or depreciation. The employee bears all the risks and responsibilities of owning or leasing a vehicle.

Taxability

Another disadvantage of a car allowance is that it may also be subject to income tax. However, unlike a company car benefit based on a fixed formula, a car allowance benefit can be reduced by deducting eligible car expenses incurred for business use of the vehicle. To do so, the employee must keep accurate records of their mileage rate and fees and file them with their tax return – this is particularly inconvenient if the nature of their work involves a lot of high mileage to keep tabs on. (That’s why companies outsource reimbursement programs to reimbursement software providers.)

Which option is best for business: car allowances or mileage reimbursement programs?

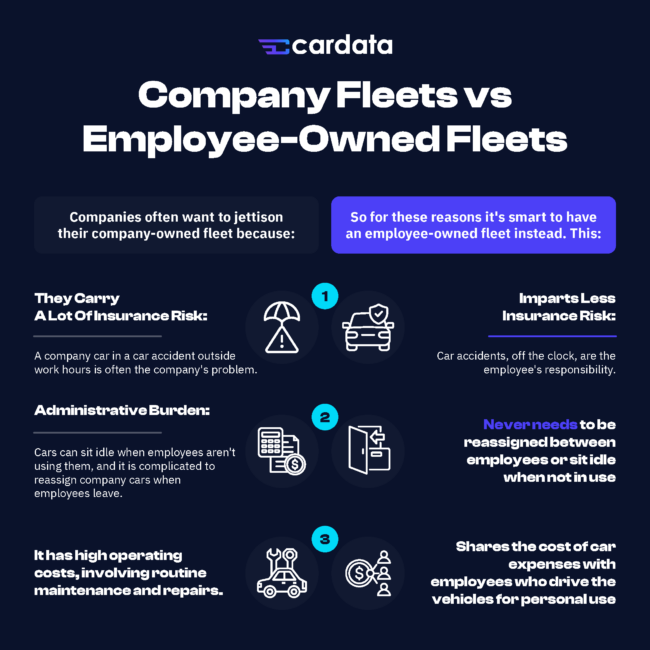

The short answer is that company-provided vehicles are far too pricey and risk-burdened, while unjustified company car allowance programs pale in cost-effectiveness compared to mileage reimbursement programs, which have no tax on them and, in the end, will give your employees more bang for their buck. At the same time, employers are less exposed to the risk of off-the-clock accidents should their workers choose to take home their cars.

- A car allowance can save money for both parties. For employers, a car allowance can reduce their overhead costs and liabilities associated with owning or leasing vehicles for their employees. A car allowance can lower their taxable income by allowing employees to claim deductions for business-related expenses.

- A car allowance can increase satisfaction and motivation for employees. By giving them more choice and control over their vehicle, a car allowance can boost their morale and loyalty. If they use their car, employees can drive a vehicle they enjoy and are comfortable with, which is a huge perk if your workers are required to spend a lot of time on the road.

- Providing a company car to employees can be a valuable employee benefit that can attract and retain talent. On the other hand, a car allowance provides employees with a fixed amount of money each month to use towards the lease or purchase of their vehicle.

- The decision between a company car and a car allowance depends on various factors such as the budget, the employees’ needs, and the business’s nature.

- Mileage reimbursement is more beneficial to the company as there is no tax, especially when a company expects an employee to accumulate many business miles.

- A reimbursement program offers employees payment for using their personal vehicle for business purposes. It is tax-free up to the amount of the IRS standard mileage rate, which is currently 65.5 cents per mile for business use.

- In contrast, a car allowance is a fixed amount paid to employees each month to use towards the lease or purchase of their own vehicle. It is subject to payroll tax and income tax—unless you turn it into a tax-fee car allowance!

Are car allowances considered company expenses?

- A car allowance is an expense to the company if it is not set up as a tax-free car allowance or FAVR (Fixed and Variable Rate) program.

- If a car allowance is set up correctly, the company may retain payroll tax, and the employee may lose income tax.

- However, if a car allowance is set up as a tax-free car allowance or FAVR program, it can provide tax benefits to both the company and the employee.

Is there a tax benefit to a car allowance?

Yes, there is a significant tax benefit to car allowances, so long as they are set up correctly as tax-free car allowances or FAVR programs, there can be a tax benefit to both the company and the employee. Doing so will save companies up to 30% on their vehicle reimbursement payments. Additionally, employees can save on income tax if the company was paying a $600 allowance before; going with a tax-free car allowance or FAVR program can save $180 for the company and the employee combined.

Conclusion

Ultimately, while a benefit in kind like a company car may be a highly regarded option and offer excellent visibility for a company, the prestige becomes much less palatable once the tax rate is considered. FAVR may also be a better choice if your employees would prefer to use their personal cars while optimizing tax deductions and tracking mileage with precision. A BIK isn’t as kind or cost-effective if high business mileage is at the heart of your vehicle program.

Disclaimer: nothing contained in this blog post is legal, accounting, or insurance advice. Consult your lawyer, accountant, or insurance agent, and do not rely on the information contained herein for any business, personal financial, or legal decision-making. While we strive to be as reliable as possible, we are neither lawyers nor accountants, or insurance agents. For several citations of IRS publications, on which we base our blog content ideas, please always consult this article: https://www.cardata.co/blog/irs-rules-for-mileage-reimbursements. For Cardata’s terms of service, go here: https://www.cardata.co/terms.

Share on: