Tax-Free Car Allowance (TFCA)

Find flexibility and savings with a Tax-Free Car Allowance, a benefit that fits your team’s driving needs.

Book a demoBig savings with no hassle.

Avoid tax waste

Stop losing money from car allowances and make your business tax-efficient.

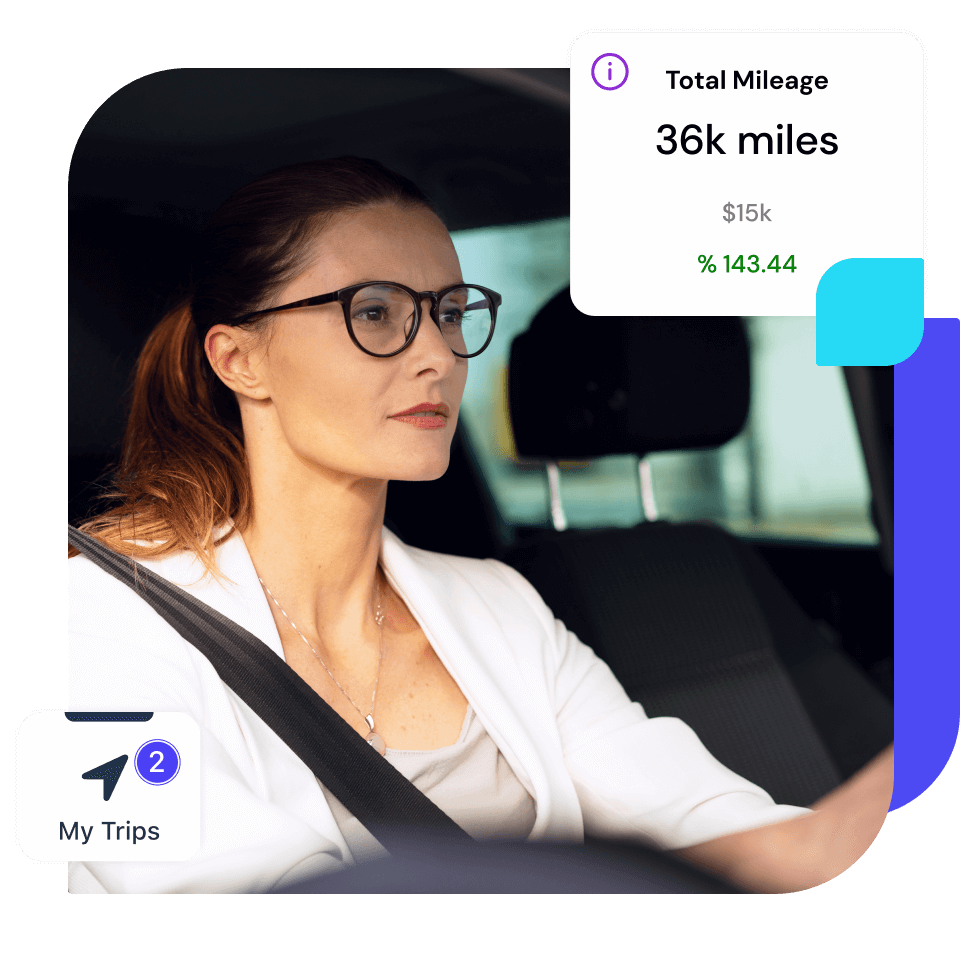

Streamline logs and payments

Save hours of work by automating mileage logging and payment processing.

Maintain insurance compliance

Verify driver insurance policies to minimize your risk profile.

Why Tax-Free Car Allowance?

Reimburse flexibly, reduce your tax, stay compliant.

A tax-free car allowance (TFCA) is an IRS-compliant method of reimbursement that enables organizations to offer a fixed reimbursement component to their drivers with the potential to be 100% tax-free.

With fewer compliance requirements than FAVR, this program allows you to offer fair market reimbursements in a flat allowance or a fixed-and-variable format, tax-free up to the IRS standard rate.

- Reimburse fairly and competitively using real market data

- Limited compliance regulations, simply capture your business miles

Reimbursement a simple flat amount, or build fixed and variable rates based on mileage estimates to avoid tax risk.

Drive easy with Cardata’s TFCA program:

Leverage powerful software

Mileage tracking, payment processing, and business intelligence reports turbocharge your program.

Never miss a mile with best-in-class GPS capture technology.

Manage drivers, approve mileage, and generate reports with Cardata Cloud.

Precisely process payments for your employee drivers.

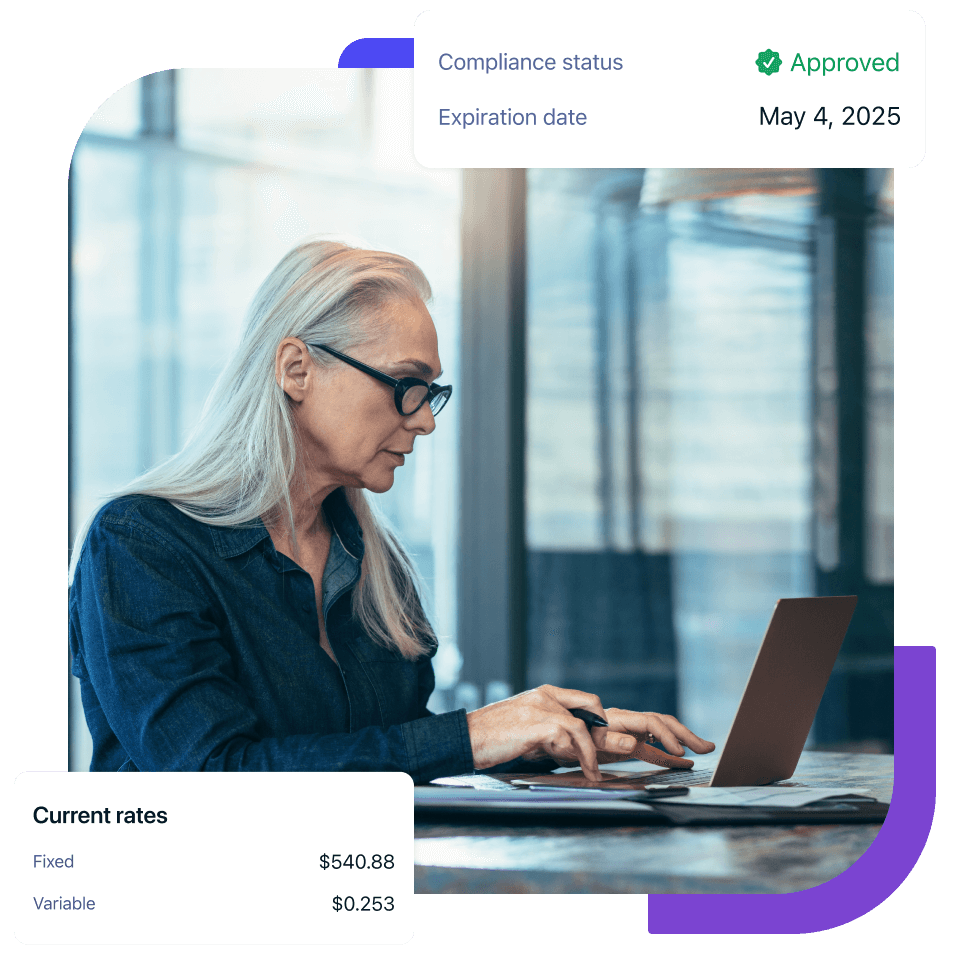

Drive compliance

Reduce liability and promote accountability. Define your company driving policy and validate insurance.

Design your vehicle reimbursement program policy.

Validate your employees’ insurance coverage with simple software.

Adhere to corporate policies and IRS guidelines with expert help.

Ensure total tax-efficiency

Get the most from your reimbursement program. Stay totally tax-compliant and streamline employee operations so you can save money and keep growing your business.

Easily separate reimbursements from income. Stay in the IRS good books.

Maintain federal tax compliance so you can focus on growing your business.

Ensure employees get accurate reimbursements and minimize tax waste.

Get expert support

Whether you need support managing your program or you find yourself getting tied up in administrative work, you can rely on Cardata’s 20+ years of experience.

Connect with an account manager to ensure your program is working for you.

Outsource administration to our experts for complex reimbursement tasks.

Leverage Cardata’s 20-year track record of providing TFCA support.

See what users are saying

Don’t just take it from us. Hear why best-in-class enterprises use Cardata’s TFCA program and software for employee driver mileage reimbursement.

Reimagine your reimbursements.

Book a demoFAQ about TFCA

A tax-free car allowance (TFCA) is any car allowance that is accountable and compared to the IRS standard rate to determine taxation. These allowances are governed by IRS policy set out in IRS publication 463.

Cardata administers TFCAs for their clients.

Firstly, you don’t have to! We run hybrid programs for our clients, which combine elements of several programs.

Moreover, the best way to determine is to call us! After a few questions about driver behaviour and company goals, we can assist in determining the balance of programs best suited for your organization!

When your employees drive for work, they incur fixed and variable expenses. An example of the former is depreciation; of the latter, gas.

Our Tax-Free Car Allowance reimbursements cover these expenses, meaning your employees do not pay out of pocket to drive.

As long as your drivers meet the criteria for the TFCA program, reimbursements are paid totally tax-free. Driving is a legitimate business expense; the IRS enshrines that in its guidance for programs like these.

Cardata uses software and keen program oversight to keep your program IRS-compliant and tax-efficient.

Cardata verifies every driver’s insurance policy to minimize your risk profile. The wrong insurance endorsement can leave you liable, but Cardata takes care of that. There are more than 100 insurers in the US, but we have the expertise to verify all their various policies.

The right insurance coverage is a requirement for FAVR programs. Cardata works with every driver to make sure they are covered.

Still have questions?

Contact usThe Cardata savings calculator

Find out what efficiencies await. Compute the future business benefits a new vehicle reimbursement program could bring.