Erin Hynes

20 mins

Fixed and Variable Rate (FAVR) Reimbursements: A Guide

A FAVR reimbursement is a tax-free car allowance for your mobile workforce. An IRS-compliant program, it lets companies reimburse mobile employees who use their personal vehicle for work.

Speak to an Expert

Book a CallWhen employees use their own vehicles for work, reimbursement isn’t just a payroll detail. It affects taxes, compliance, cost control, and whether employees feel the program is fair. This is why choosing the right vehicle reimbursement model is a strategic decision for any company that has a mobile workforce.

One option that companies are turning to is Fixed and Variable Rate (FAVR) reimbursement. It’s a structured, IRS-approved way to reimburse employees based on what it actually costs to drive for work, instead of relying on flat allowances or one-size-fits-all mileage rates.

This guide explains everything organizations need to know about FAVR, including:

- What a FAVR program is and how it works

- Why companies choose FAVR over taxable car allowances or company-assigned vehicles

- How to calculate fixed and variable driving costs accurately

- The role mileage tracking plays in maintaining IRS compliance

- When it makes sense to outsource FAVR administration

If your organization has field employees, sales teams, service technicians, or any other frequent full-time drivers, understanding FAVR can help you move away from older vehicle programs and replace them with something that’s compliant, tax-efficient, and easier to defend.

Let’s get started.

What is FAVR? A Clear Definition

FAVR stands for “Fixed and Variable Rate.” It’s an IRS-approved mileage reimbursement strategy designed for select employees who use their personal vehicles for business driving.

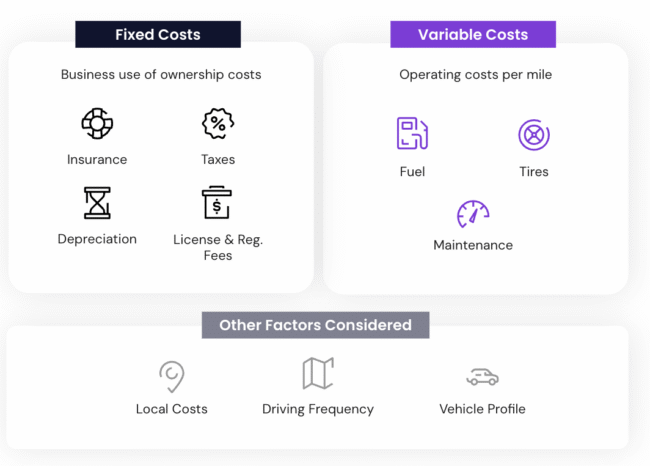

FAVR reimburses employees by separating driving expenses into two categories: fixed ownership costs and variable operating costs.

Fixed costs cover the core expenses of owning a vehicle, things like depreciation, insurance, registration, and taxes. These costs stay relatively consistent whether you drive 500 miles or 25,000. Variable costs cover the expenses that increase as you drive more, things like fuel, maintenance, oil changes, and tire replacement.

By separating those costs, FAVR matches how much these vehicles would actually cost in the real world.FAVR is a sanctioned program under IRS rules in the United States.

When it’s set up correctly and managed consistently, employers can reimburse employees for business driving on a tax-free basis. That allows companies with mobile teams to support employee-owned vehicles while still keeping compliance and cost control in place.

FAVR Reimbursements Vs. Company-Owned Fleets

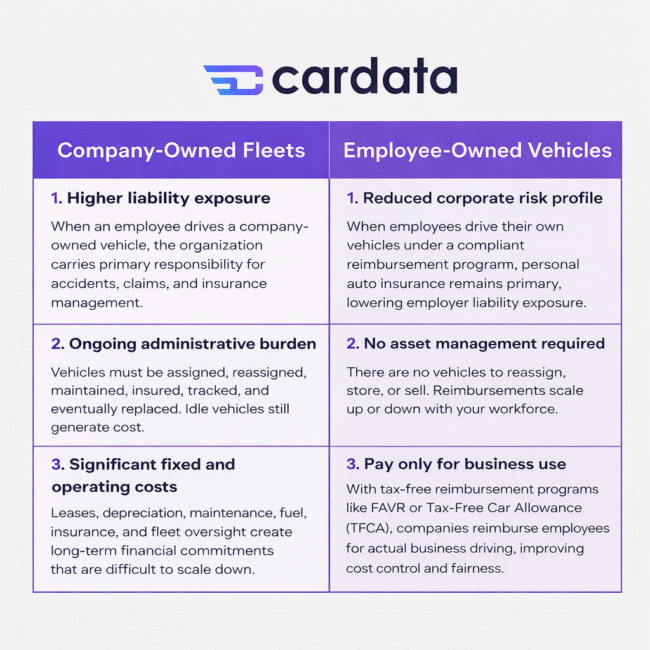

A FAVR program is commonly used when a company transitions from a company-owned fleet to an employee-owned fleet model.

In a traditional fleet, the company owns or leases vehicles and assigns them to employees. The business takes on the full responsibility: insurance, maintenance, depreciation, and the admin work that comes with managing a fleet over time.

An employee-owned fleet works differently. Instead of issuing company cars, employees use their personal vehicles for business driving, and the company reimburses them for that use.

This is where FAVR comes in.

FAVR gives companies a structured, tax-free reimbursement framework that allows them to replace fleet vehicles while keeping fairness and compliance intact. Rather than owning the vehicles directly, the company reimburses legitimate business driving costs through a combination of fixed and variable payments.

Many organizations move away from company-owned fleets for reasons that come down to risk, cost, and complexity.

Company fleets can increase insurance exposure. If an employee is in an accident outside work hours, liability may still land on the employer because the vehicle is company property.

Beyond that, fleet vehicles can sit unused when someone changes roles, goes on leave, or leaves the company. But let’s be real. Reassigning vehicles sounds simple until you’re doing it repeatedly across departments and regions.

Fleets also come with ongoing operating costs that aren’t always predictable. Routine maintenance is expected, but repairs and downtime add up. Over time, you also have the longer-term burden of managing assets, replacing vehicles, and keeping everything documented.

By contrast, an employee-owned fleet supported by a FAVR program shifts vehicle ownership to employees while still covering business driving.

This approach reduces employer insurance exposure, removes the logistics of reassigning vehicles, shares vehicle ownership costs between business and personal use in a way that makes sense, and preserves tax efficiency through a compliant reimbursement model.

In short, FAVR is the mechanism that makes an employee-owned fleet model workable. It lets companies step away from managing vehicles directly while still covering business driving costs in a structured, defensible way.

How Taxes Change When Replacing a Company Fleet

When a business owns or leases vehicles as part of a fleet (or company car) program, those vehicles are considered business assets used for work purposes. The company is responsible for expenses such as fuel, maintenance, insurance, and depreciation, and these costs are generally treated as business expenses.

The tax treatment for fleet vehicles depends on how the vehicle is used. If a company vehicle is used exclusively for business, like pooled vehicles not permitted to be taken home after-hours or on the weekends, it is not considered taxable as long as its business use is properly documented.

But when personal use occurs, like commuting, the IRS treats that portion as a taxable fringe benefit. Businesses are supposed to track and report personal mileage accurately to remain compliant, and may use personal use chargebacks or fringe benefit calculations to account for non-business driving.

Because of these requirements, fleet programs involve not only operating costs, but also administrative and payroll compliance considerations tied to separating business and personal use.

When an organization moves away from company-owned vehicles and shifts to an employee-owned model, the driving doesn’t stop, but the tax treatment changes.

Instead of paying vehicle expenses directly, the company reimburses employees for using their personal vehicles. Whether that reimbursement is tax-efficient or becomes taxable income depends on how the program is structured and what documentation exists to support it.

This is where many companies accidentally create tax waste. In practice, a common fleet replacement is a flat car allowance.

On the surface, a flat allowance feels predictable. You pick a monthly amount, you pay it, and you move on. The problem is how the IRS treats it.

If that allowance is paid without justification (things like mileage logs, business use documentation, or cost validation) it is treated as income. It runs through payroll. Employees pay income tax on it. Employers pay payroll taxes on it. In many cases, 30 to 40 percent of the allowance is lost to taxes.

A FAVR program works differently.

While it sometimes gets described as a type of car allowance, it’s more accurate to think of it as a justified reimbursement. Under IRS rules, FAVR programs require documentation, mileage tracking, and cost data tied to the employee’s location and vehicle. When those requirements are met, the IRS treats FAVR payments as tax-free business reimbursements rather than taxable income.

That distinction is the whole point. A poorly structured allowance is viewed like extra compensation. A compliant FAVR program preserves the tax efficiency companies are used to with fleets, while allowing employees to use their own vehicles.

This difference in structure is what determines whether a fleet replacement quietly creates tax waste or maintains a clean, defensible tax position.

Now that we’ve covered how fleets are replaced and how tax treatment changes, it’s important to look more closely at how FAVR actually works in practice.

FAVR Compared to Other Mileage Reimbursement Options

Before calculating fixed and variable rates, it helps to understand the other mileage reimbursement options companies typically consider.

Most organizations that move away from company-owned fleets start with either a cents-per-mile program or a flat car allowance. These approaches are easier to administer, but they only reimburse part of what it really costs to own and operate a vehicle for work.

FAVR exists because neither approach fully reflects real business-required vehicle costs on its own. Understanding where each option works (and where it falls short) makes it clear why FAVR combines both models into one program.

Variable-Style Reimbursements: Cents-Per-Mile (CPM)

A Cents-Per-Mile (CPM) reimbursement pays employees a dollar amount for every business mile they drive. It’s calculated by multiplying business miles by a per-mile rate.

This type of program reimburses in a variable format: assuming expenses increase as mileage increases. What it does not do is separate the fixed costs of owning a vehicle.

The most common approach to a CPM program uses the IRS standard mileage rate as the per-mile payment. This rate is updated annually by the IRS and represents an estimated national average cost of operating a vehicle.

When employers reimburse at or below the IRS rate and keep proper mileage logs, those payments can be made tax-free. Mileage logs must include details like trip dates, destinations, business purpose, and miles driven.

The IRS rate is designed to be simple and widely usable, and it’s updated annually to reflect the national average cost of driving in the United States. It isn’t tailored to specific vehicles, specific regions, or different driving patterns.

That’s why CPM can sometimes overpay when assigned to the wrong employee groups. Since the IRS rate is a national average, it can end up being generous for high-mileage drivers in lower-cost regions.

A driver in Texas doing mostly highway miles, with relatively low fuel prices and mild conditions, may have an actual cost per mile that’s much lower than the IRS rate. In those cases, CPM can pay more than it truly costs to operate the vehicle, inflating reimbursement budgets without improving fairness.

Fixed-Style Reimbursements: Flat Car Allowances

A flat car allowance is a fixed monthly payment given to employees who use their personal vehicles for work. It does not change based on miles driven and is usually paid through payroll.

Flat allowances are often meant to help cover ownership costs, but they don’t directly account for actual business mileage.

Most flat car allowances are taxable income. If the allowance is paid without substantiation (such as mileage tracking or cost validation) the IRS treats it as compensation.

Allowances can be made partially or fully tax-free only when structured under an accountable plan, which requires documentation of business use and limits reimbursement to reasonable expense levels. Without that structure, allowances are subject to payroll and income taxes for both employers and employees.

Even when taxes aren’t the main issue, fixed-only reimbursements struggle with fairness because they ignore usage.

High-mileage drivers may find the allowance doesn’t come close to covering fuel, maintenance, and wear and tear.

Low-mileage drivers may be overpaid compared to their actual expenses. Because the payment doesn’t change with mileage, the program has a hard time staying equitable across different roles, regions, and driving patterns.

Why FAVR Combines Fixed and Variable Costs

FAVR programs exist because vehicle expenses aren’t purely fixed or purely variable. Some costs are there no matter what, like insurance and depreciation. Others rise as mileage rises, like fuel and maintenance.

By combining both components into a structured reimbursement model, FAVR aligns reimbursement with how much vehicles actually cost to own and operate. The result is more accurate and more consistent, and it’s better suited for replacing fleets and taxable allowances.

Is a FAVR Program Complicated?

Compared to other vehicle reimbursement options, FAVR can feel more complex, mainly because it relies on detailed cost data to build accurate rates. It’s one of the most detailed mileage reimbursement programs recognized by the IRS, with pages of formal guidance behind how it needs to be structured and managed.

That level of detail can be difficult to manage internally, which is exactly why having the right partner matters. A partner like Cardata handles the structure, data, and compliance oversight for you, so you get the benefits of FAVR without the administrative burden.

That complexity isn’t there to make life harder. It’s there because FAVR is designed to reimburse real, business-required vehicle costs, with data acting as the receipt that proves those payments are reimbursement, not income.

To do that properly, the program has to use real cost data, document business use, and meet specific IRS requirements. When those rules are followed, the reimbursement can be both fair to employees and tax-free for everyone involved.

The main reason FAVR feels more complicated is that it has two parts, and each part is calculated differently.

- Fixed costs (like insurance, registration, and depreciation) exist whether someone drives 500 or 2,500 miles in a month. These are reimbursed through a flat monthly payment.

- Variable costs (like fuel and maintenance) change with mileage, so they’re reimbursed using an additional cents-per-mile rate.

FAVR combines both fixed and variable approaches so reimbursements match how vehicle costs are actually incurred. The tradeoff is more structure. The payoff is lower tax waste, better fairness, and stronger IRS defensibility.

Who Is a Good Fit for a FAVR Program?

A FAVR program is designed for employees who regularly drive their personal vehicles for work and need a reimbursement model that is accurate, fair, and tax-free under IRS rules. While FAVR is one of the most effective reimbursement options available, it is not the right fit for every role or every department in an organization.

Organizational Fit for FAVR

From an employer perspective, FAVR is the best fit for organizations with multiple frequent drivers. Companies with five or more eligible drivers who are full-time employees tend to see the most tax advantages from a FAVR program.

Because FAVR relies on cost data, mileage tracking, and compliance oversight, it is especially effective for companies that want a standardized, defensible reimbursement structure across teams and regions.

Employees Who Are a Strong Fit for FAVR

FAVR works best for full-time employees who drive a meaningful amount of business mileage each year. In most cases, this means drivers who log at least 5,000 business miles annually and use their vehicle consistently as part of their job.

Common roles that are well suited for FAVR include:

- Field sales representatives

- Service and maintenance technicians

- Merchandisers and territory-based roles

- Project managers and field engineers

- Other fulltime employees with recurring driving requirements

These employees incur both fixed ownership costs and variable operating costs, which is exactly what FAVR is designed to reimburse.

When FAVR May Not Be the Best Option

FAVR is not always the right solution for occasional or low-mileage drivers. Employees who drive infrequently, or who log fewer than 5,000 business miles per year, may be better served by simpler reimbursement programs.

In those cases, options such as a CPM program or a Tax-Free Car Allowance may be more appropriate and easier to administer.

IRS Rules and Eligibility Requirements for FAVR

A FAVR program is not an “anything goes” reimbursement. It does offer tax advantages, but those benefits come with clear IRS guidelines to make sure reimbursements are tied to real business driving expenses.

There’s a simple reason for these requirements: to prevent misuse. Without guardrails, flat stipends or padded reimbursements could turn into tax-free income instead of covering real vehicle costs. The IRS puts clear rules in place to make sure FAVR stays a solid, business-only reimbursement model.

Core IRS Eligibility Requirements

To qualify for a compliant FAVR program, both the company and the employee must meet certain conditions.

At the organizational level, a company has to have five or more employees enrolled in FAVR within the same program. FAVR is intended for structured reimbursement programs, not one-off arrangements for individual drivers.

At the employee level, FAVR is designed for full-time employees who drive regularly for work. Contractors or 1099 workers aren’t eligible. Employees must drive at least 5,000 business miles per year, with mileage prorated if they are not enrolled for the full year.

Vehicle and Insurance Standards

The IRS also places limits on the vehicles used in a FAVR program to ensure reimbursements are reasonable and consistent.

Employees’ vehicles need to meet the company’s defined vehicle standard. In simple terms, the original MSRP can’t exceed 90% of the program’s standard vehicle cost. The vehicle also has to fall within the company’s set retention cycle, which is usually between three and seven years.

On top of that, employees have to carry insurance that meets or exceeds company requirements. This helps protect both the employee and the employer, and reinforces that the reimbursement is legitimate and tied to real business use.

Mileage, Documentation, and Program Consistency

FAVR compliance really comes down to good documentation and staying consistent.

Employees are required to:

- Track business mileage accurately

- Deduct commute mileage from reimbursement

- Submit an annual odometer declaration

Reimbursement rates are based on the employee’s home address and are updated regularly using local cost data, ensuring payments reflect real regional driving expenses rather than national averages.

Programs have to be applied consistently across eligible employees. Selective participation or ad hoc exceptions can undermine compliance and trigger scrutiny.

Why Compliance Matters

If these requirements aren’t followed, the IRS can reclassify FAVR payments as taxable income. When that happens, those reimbursements may be subject to payroll and income taxes for both the employer and the employee.

But when it’s set up and managed properly, FAVR is still one of the only reimbursement models that lets companies replace fleets or taxable allowances with a fully tax-free, IRS-compliant alternative.

How FAVR Reimbursements Are Calculated

FAVR reimbursements are built around actual vehicle costs, as the IRS requires. To calculate compliant FAVR rates, employers need to collect cost data and split it into two buckets: fixed costs and variable costs.

This setup is what makes FAVR both accurate and tax-free. Each category is calculated differently and plays a specific role in how the program works.

Fixed Costs Covered by FAVR

Fixed costs are expenses that exist regardless of how many miles an employee drives. These costs are reimbursed through a flat monthly payment.

Fixed expenses typically include:

- Vehicle depreciation or lease payments

- Insurance premiums

- License and registration fees

- Personal property taxes, where applicable

These costs are tied to vehicle ownership rather than usage, which is why they are paid as a consistent monthly amount.

Variable Costs Covered by FAVR

Variable costs change based on how much an employee drives. These expenses are reimbursed using a cents-per-mile rate that applies only to business mileage.

Variable expenses typically include:

- Fuel

- Oil changes

- Tires

- Routine maintenance

- Repairs

This cost framework is outlined in IRS guidance and forms the basis of compliant FAVR calculations.

To build accurate rates, employers must determine how much each of these expenses costs on a per-mile basis. This requires gathering reliable cost data, which is one reason many organizations choose to outsource FAVR administration.

How Variable Costs Are Calculated

Variable costs are calculated by converting common driving expenses into a cost-per-mile figure.

For example, if an oil change costs $40 and is required every 5,000 miles, the oil change cost equals less than one cent per mile. If fuel costs $4 per gallon and a vehicle averages 40 miles per gallon, fuel costs ten cents per mile.

The same approach applies to tires, repairs, and maintenance. A $400 set of tires rated for 50,000 miles results in a per-mile tire cost of under one cent.

These costs are often location-specific. Fuel prices, labor rates, and maintenance costs vary by region, which is why FAVR programs can adjust rates based on where employees drive.

How Fixed Costs Are Calculated

Fixed costs are calculated on a monthly basis.

Depreciation is determined by estimating how much a vehicle type loses in value each year and dividing that amount by twelve. Insurance premiums, registration fees, and other ownership costs are added to produce a total monthly fixed cost.

That total becomes the employee’s fixed reimbursement amount. This payment is issued regardless of mileage and reflects the ongoing cost of owning a vehicle for work.

Together, fixed and variable calculations allow FAVR programs to reflect real-world driving expenses while meeting IRS requirements for tax-free reimbursement.

How FAVR is Administered Internally

There’s no getting around it: FAVR is a structured program. It includes eligibility rules, rate calculations, documentation standards, and ongoing compliance oversight. Compared to simpler options, it takes more coordination and consistency.

But that doesn’t mean it’s unmanageable.

When administered internally, FAVR usually comes down to three ongoing responsibilities: managing rates, tracking mileage, and monitoring compliance.

Companies need to calculate and update fixed and variable rates using current cost data. Because rates are tied to vehicle profiles and regional expense data, they have to be reviewed regularly to stay accurate and compliant.

Employees have to capture business mileage accurately, including trip dates, destinations, mileage totals, and required documentation like annual odometer declarations. In the past, that meant spreadsheets and manual logs. Today, mileage tracking apps automate much of the process by capturing trips in real time and handling commute deductions automatically.

Administrators also have to monitor compliance, which includes verifying insurance, confirming vehicle eligibility, ensuring mileage thresholds are met, and applying IRS rules consistently across participants.

Modern tools reduce the administrative burden by centralizing rate calculations, automating approvals, flagging compliance issues, and producing audit-ready reports. The structure stays, but the work becomes routine rather than stressful.

How to Get Started With FAVR

At first glance, FAVR can sound complicated and work-intensive. It comes with rules, data requirements, and compliance checks that simpler programs don’t have. But that structure comes with benefits, like tax efficiency.

It’s designed to replace fleets and taxable allowances with a reimbursement model the IRS recognizes as legitimate, defensible, and tax-free. When it’s done properly, it reduces tax waste, makes reimbursements more accurate, and supports fairness for both high- and low-mileage drivers.

For many organizations, the real challenge isn’t deciding whether FAVR makes sense. It’s managing the calculations, documentation, and compliance over time. That’s where a partner like Cardata comes in.

By handling the data, mileage tracking, and IRS requirements behind the scenes, Cardata reduces the administrative load while preserving the tax advantages that make FAVR worthwhile.

Getting started with FAVR doesn’t mean taking on more work. With the right structure and support, it means replacing outdated vehicle programs with a modern, tax-efficient solution that runs smoothly in the background.

Fixed and Variable Rate FAQs

1. Is FAVR taxable?

No, FAVR reimbursements are not taxable when the program is structured and administered correctly.

Under IRS rules, FAVR is an accountable reimbursement plan. When employers meet documentation, mileage tracking, and compliance requirements, reimbursements are treated as legitimate business expenses rather than income. This means payments are not subject to payroll or income tax.

If a FAVR program falls out of compliance, however, some or all reimbursements may be reclassified as taxable income.

2. Can FAVR be mixed with other programs?

Yes, FAVR can be used alongside other vehicle reimbursement programs.

Some organizations use FAVR for high-mileage, full-time drivers while covering lower-mileage or occasional drivers with alternatives such as CPM program or a Tax-Free Car Allowance.

The key is consistency. Each employee should be enrolled in the reimbursement program that best fits their role and driving pattern, and programs must be administered separately to maintain IRS compliance.

3. Can small teams use FAVR?

FAVR is typically best suited for teams with five or more eligible drivers. The IRS requires a minimum number of participants to support a compliant FAVR program, and companies with multiple frequent drivers tend to see the greatest benefit.

Smaller teams or organizations with fewer drivers may find simpler programs more practical, though FAVR can still be an option depending on mileage levels and administrative support.

4. What happens if mileage changes?

FAVR adjusts automatically as mileage changes. The variable portion of FAVR reimbursement increases or decreases based on actual business miles driven, while the fixed portion remains consistent to cover ownership costs.

If an employee’s annual mileage drops below eligibility thresholds, they may no longer qualify for FAVR and could be moved to a different reimbursement program. Regular monitoring ensures reimbursements remain accurate and compliant.

Share on: