Speak to an Expert

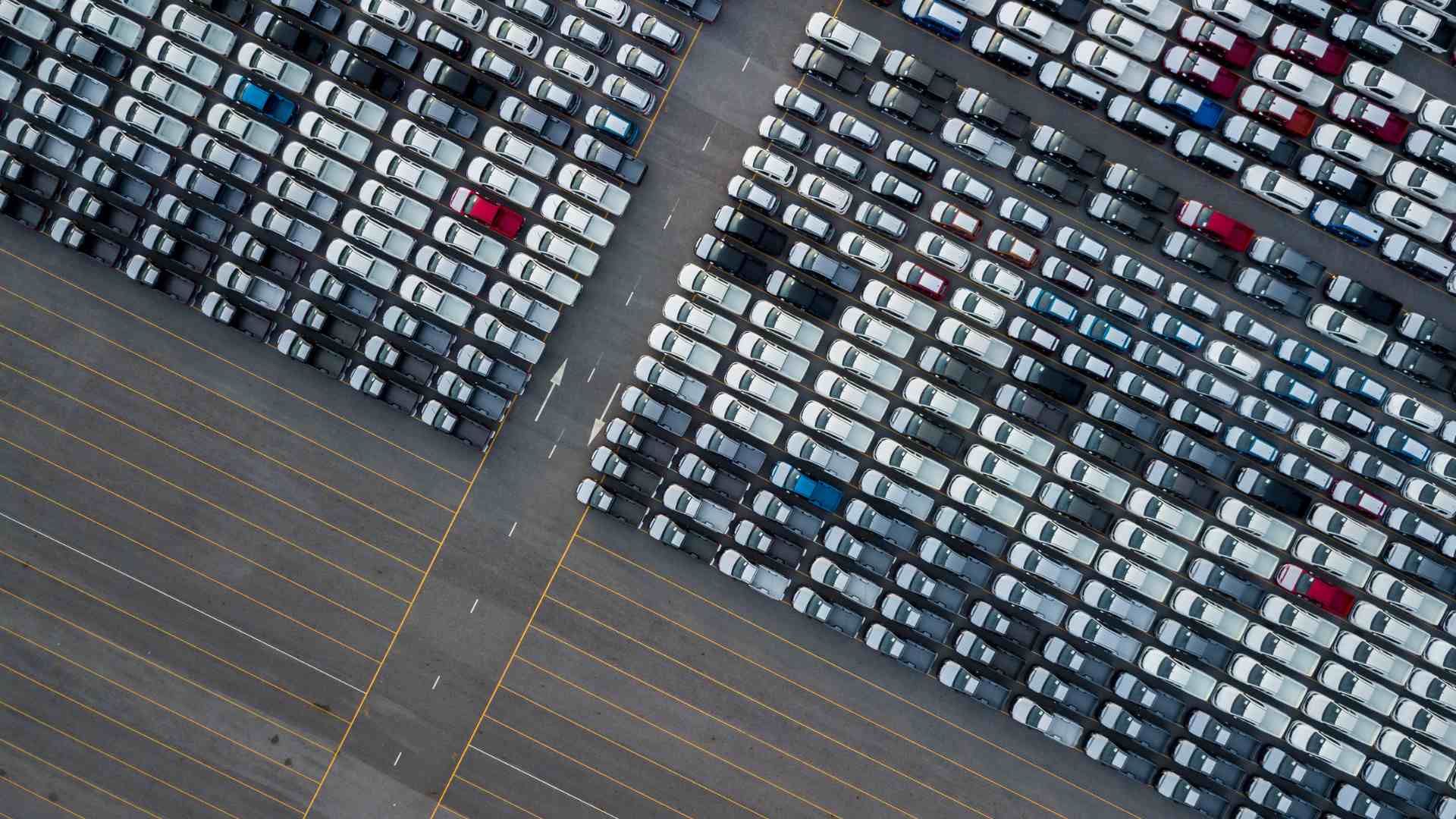

Book a CallManaging a fleet program might seem like the smartest way to meet those mobile business needs, especially when you have field teams that rely on vehicles on an everyday basis. But what happens when the costs of running a fleet start to outweigh the benefits? Countless business owners are finding themselves dealing with ever-increasing expenses, unpredictable maintenance costs, and administrative migraines, all of which negatively impact the company’s bottom line.

In this blog, we’re going to break down the financial disadvantages of operating a fleet and how to overcome them. We’ll also look at cost-effective alternatives like vehicle reimbursement programs (VRP), and why partnering with vehicle partners like Cardata is the smart move to optimize your fleet strategy.

Financial disadvantages of operating a fleet program

High acquisition and depreciation costs

Buying or leasing a fleet of vehicles requires a huge upfront investment that most companies struggle to find. Vehicles depreciate in value quickly, and what seemed like a great deal at purchase time can turn into a money pit as the cars age. Businesses typically feel this hit directly to their cash flow, especially when they’re forced to upgrade to new vehicles after a few years to keep the fleet trustworthy and reliable.

So here’s a solution! A vehicle reimbursement program (VRP) can eliminate this issue by reimbursing employees for using their own personal vehicles for work, removing the need for vehicle acquisition altogether. Your business reimburses for the actual miles driven, variable and fixed costs, saving big on ownership and operational costs.

Maintenance and repair costs

Fleet vehicles can require a lot of regular maintenance. Things like oil changes, tire rotations, brake inspections, and more. As vehicle maintenance issues come up, unexpected breakdowns can mean even higher costs, especially for older vehicles. These unplanned expenses increase downtime, disrupting workflow and operations and inflating the total fleet costs. In fact, maintenance and repair costs can rise as much as 10-15% annually as vehicles age and require more frequent service.

Insurance and liability expenses

As your fleet size grows and scales, so do your insurance premiums. Covering the entire fleet means you’re also paying out for all the dings, knicks, and larger accidents, as well as fleet safety liabilities, and potential legal issues, which can get expensive fast. Insurance premiums can rise by up to 25% after a single at-fault accident, and larger fleets naturally face greater exposure to risk.

By transitioning to a VRP, you can seriously lower your insurance liabilities, since employees are carrying their own vehicle insurance. This minimizes the company’s exposure while still maintaining driver safety standards through driver behavior monitoring and whatever telematics software your company has integrated.

Fuel costs

Fuel is one of the most unpredictable fleet management expenses. Rising fuel costs and endlessly fluctuating prices make it annoyingly difficult to budget with any level of accuracy, especially if your fleet consists of fuel-hungry vehicles. Fuel prices rose by over 40% in the past two years alone, putting significant pressure on fleet budgets.

App software like fuel management and route optimization systems can really help your company to reduce its fuel usage. Also, by switching to more fuel-efficient vehicles or even electric options, you can help to curb your high fuel consumption.

Administrative burdens

To manage a fleet with any level of efficiency involves handling fleet operations, compliance, and vehicle tracking smartly. It also requires substantial time and resources from HR, finance, as well as procurement teams. Fleet managers spend roughly 30% of their time on administrative tasks related to compliance, record-keeping, and fleet tracking. Automation will be a lifesaver here, because manual processes will be so tedious and lead to inefficiencies, errors, and lost time.

Consider using fleet management solutions like an app with real-time vehicle tracking and operational efficiency tools to streamline all your car related processes. This can reduce the workload on the administrative staff tasks with these duties, and making it easier to manage the fleet program.

The case for alternative fleet solutions

Vehicle reimbursement programs (VRP)

A VRP lets employees use their personal vehicles for business purposes, eliminating the need for the company to own and operate and maintain a fleet of vehicles. Employees are reimbursed based on a fair, IRS compliant mileage rate, making this a super cost-effective option for businesses of all sizes, especially small businesses.

Fixed and Variable Rate (FAVR) Programs

FAVR programs are a hybrid solution that combines a fixed payment to cover the cost of owning a vehicle, like insurance, and registration, and a variable rate to cover operating costs, like fuel. This gives both the business and its mobile employees flexibility, tailoring the program to the unique and specific needs of the team and company.

Leasing vs. Owning

Leasing vehicles may seem like a clever way to keep your fleet costs low, but in reality it actually still requires long-term financial commitments. VRPs like FAVR offer so much more flexibility, like letting you keep only the vehicles you absolutely need while giving employees freedom to use their own personal vehicles for work.

Why partner with Cardata?

If you’re looking to solve the financial challenges of fleet management, Cardata offers a tailored solution for every company operating a fleet of non-specialized vehicles. Here’s how we can help you optimize your fleet management strategy:

Cardata’s reimbursement programs

At Cardata, we specialize in helping businesses like yours streamline their vehicle programs by transitioning to cost-effective reimbursement models like FAVR. Our customers have saved an average of $2,000 per driver annually by moving to our reimbursement solutions. Our app automates mileage tracking, ensuring accurate, IRS compliant reimbursements.

Reduce your fleet size with a VRP

If/when you partner with Cardata, you can reduce your fleet size by shifting to a VRP that compensates employees for using their personal vehicles. This saves you on maintenance costs, insurance, fuel costs, and liability, all while retaining the functionality of a full fleet. Companies have reduced their fleet sizes by up to 20%, freeing up capital for other business needs.

Conclusion

Operating a fleet can be expensive, but by being proactive and savvy, you can avoid unnecessary costs. Solutions like FAVR programs are tailored to meet your business needs without the financial strain of maintaining a fleet of vehicles. By partnering with Cardata, you’ll streamline fleet operations, cut costs, and increase operational efficiency, all while ensuring your drivers are safe and well-supported.

Ready to optimize your fleet strategy? Reach out to Cardata today.

Sources

1. Fleet Management Solutions: Cost Savings and Optimization (https://www.fleetsolutions.com)

2. The Impact of Fuel Efficiency on Fleet Management (https://www.fuelefficiency.com)

3. Vehicle Depreciation and Its Effect on Fleet Costs (https://www.fleetcostsavings.com)

4. VRP and FAVR Programs: How They Can Help Your Business (https://www.reimbursementprograms.com)

Share on: