Car allowances are a common way for companies to support employees who drive their own vehicles for work. But how much is “enough” in 2026?

In this guide, we break down the current average car allowance, what it actually covers, how rising costs impact drivers, and what businesses can do to offer fair, tax-efficient reimbursements.

If you’re wondering whether your allowance program still makes sense, you’re in the right place.

What Is a Car Allowance?

A car allowance (also known as a car stipend or vehicle allowance) is a reimbursement that employers give to employees who use their own car for work. It’s meant to help cover the everyday costs of driving for business, like gas, insurance, wear and tear, and routine maintenance.

These allowances are typically a flat amount that is added to an employee’s regular paycheck, usually on a monthly basis.

Oftentimes, there is no mileage tracking requirement or expense receipts involved, it’s just a set payment, no matter how much or how little the employee actually drives for work.

The Average Car Allowance in 2025

When you look up the average car allowance for 2024 online, you’ll see a range of figures. However, most sources land in the same range: the average car allowance was between $575 to $600 per month in 2024.

In 2025, the average car allowance rose to just over $700 per month (Source: Internal Cardata aggregated data 2025).

This average is based on the date range of January 1, 2025 – October 31, 2025. Below, you can see the average monthly car allowance, by month, based on our internal data.

Monthly variance in car allowances is due to a couple natural fluctuations, like in fuel prices, changes in insurance premiums, seasonal driving patterns, and maintenance or repair needs.

| Reimbursement Month | Average Reimbursement Amount |

| January 2025 | $667.78 |

| February 2025 | $662.31 |

| March 2025 | $691.93 |

| April 2025 | $710.87 |

| May 2025 | $709.47 |

| June 2025 | $705.40 |

| July 2025 | $717.24 |

| August 2025 | $714.90 |

| September 2025 | $717.35 |

| October 2025 | $734.01 |

The year-over-year increase of the average car allowance makes sense, given how vehicle-related costs have been rising. Since 2020, the prices for both new and used cars have been quickly rising due to a mix of inflation, supply chain issues, and tariffs in the auto industry.

Looking ahead to 2026, we can expect vehicle costs to keep trending upward.

While some areas could see temporary relief in gas prices or used car availability, overall vehicle ownership costs are still expected to rise. But, it’s likely that the average car allowance will remain around $700 per month.

This is because many companies set their car allowance and forget about it, only updating the car allowance every few years.

Unless employers adjust their allowance rates every year, or switch to more flexible, tax-free mileage reimbursement programs, employees will likely keep absorbing the difference between what they’re paid out by a car allowance, and what they actually spend.

What Costs Should Company Car Allowances Cover?

The monthly car allowance is meant to help cover the costs that employees incur when they use their personal vehicle for work. A big chunk of that cost is fuel.

But gas isn’t the only thing your business drivers are paying for. Expected routine maintenance like oil changes, tire replacements, and general wear and tear are all part of the equation when your employees are putting miles on their car for business.

That said, the allowance isn’t meant to cover everything. It’s designed to offset the costs tied to business use only. If an employee is using the car on weekends or for errands, those personal expenses should still be the employee’s responsibility.

How Car Allowances Are Typically Structured

A flat payment to cover the cost of driving for work sounds straightforward, but the way companies structure them can vary quite a bit.

Most employers handle car allowances internally through payroll. The amount is usually paid out monthly and is often based on an employee’s role type or seniority.

For example, a sales rep covering a large territory might get a higher allowance than someone who occasionally drives to local meetings. Some companies even use location-based tiers, knowing that costs like gas or insurance can vary depending on the region.

But here’s the thing: many of these allowances are just ballpark figures. They’re often set and left alone for years, even as vehicle expenses go up or driving frequency changes. That can be frustrating for employees whose costs are climbing while their reimbursement stays the same.

There’s also rarely any mileage tracking involved. It’s just a flat amount, whether you drive 300 miles or 3,000. That simplicity is convenient for employers, but it can be unfair in practice, especially for high-mileage business drivers who end up footing the bill for business expenses out of their own pocket.

While car allowances are easy to administer, they often don’t have the flexibility and accuracy that today’s driving costs demand.

The Real Costs of Business Driving in 2025

On paper, a $700 car allowance seems like a decent amount. But once you factor in everything that goes into owning and operating a car, like gas, insurance, maintenance, and depreciation, that monthly allowance doesn’t stretch as far as you might think.

Let’s unpack the factors that most impact the cost of business driving:

1. Car Prices

Let’s start with car prices. The ATP (average transaction price) in 2025 for new vehicles has risen 3.6% year-over-year, which is the biggest jump since spring 2023. The average price for a new vehicle in the U.S. is now above $50,000 for the first time ever, according to Kelley Blue Book.

2. Fuel

Then there’s fuel. Luckily, 2025 has shaped up to actually reflect a decrease in fuel prices, compared to 2024. But while the national average has come down a bit, that doesn’t mean the pressure is off entirely.

Fuel prices vary widely depending on where a business driver is located. Employees driving in states like California or New York often pay significantly more per gallon than those in the Midwest or South.

On top of that, seasonal shifts, refinery maintenance, weather events, and geopolitical disruptions can all cause sudden spikes. So even though the year-end average might be down, many drivers still experienced periods of high fuel costs.

3. Insurance

Insurance isn’t offering any relief either. In 2025, the average cost of a full coverage policy is $2,638 a year, according to Bankrate data, or about $220 a month. That’s 12% higher than it was in 2024 and over 50% more than in 2020.

Experts say there are a few reasons behind the price hikes, like more expensive car parts and replacement vehicles to new tariffs and supply chain issues that have been hanging around since the pandemic.

4. Maintenance

And let’s not forget maintenance and repairs. Car repair costs have exploded in 2025. They are up 15% from last year, according to the latest Consumer Price Index data. The average annual maintenance cost for a car in the USA varies by source, but it generally ranges from about $800 to $1,500 per year.

This includes routine services like oil changes and tire rotations, as well as the cost of unexpected repairs. The total cost depends on the car’s age, make, model, and how well it is maintained.

5. Depreciation

As soon as a vehicle leaves the dealership lot, it loses around 30% of its value right off the bat. For business drivers putting on thousands of miles a year, that depreciation hits even harder.

The more miles they drive, the faster the value of their car drops. For employees driving long distances every week, that wear and tear adds up quickly, not just in maintenance costs, but in how much the car is worth when it’s time for them to sell or trade in.

The Tax Implications of a Car Allowance

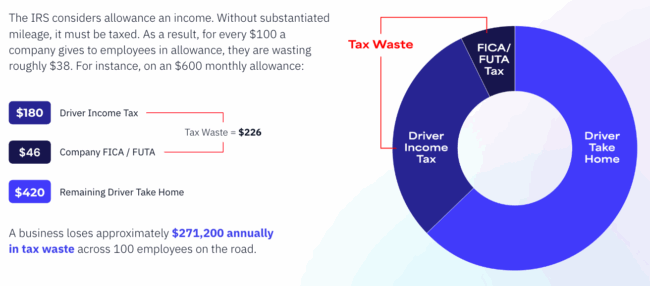

There’s another catch to car allowances, too. Most car allowances are paid as flat amounts, and unless they’re structured under an IRS-compliant accountable plan, they’re fully taxable.

The IRS taxes lump-sum car allowances as income, unless very special conditions are met.

Car allowances are subject to three taxes: Federal, state, and FICA. These taxes impact both the employer and employee, and amount to a total of almost 38%, which adds up, fast.

So while the average car allowance has gone up in 2025, it’s still worth asking: is a flat monthly payment enough anymore? Is it too much? For many businesses, it might be time to explore smarter, fairer ways to support their mobile workforce.

How to Make Your Car Allowance Tax-Free

Many companies don’t realize that their car allowance programs are costing both them and their employees more than they should, simply because they aren’t set up the right way.

By default, flat car allowances are treated as taxable income unless they’re structured under what the IRS calls an accountable plan.

The good news?

With the right setup, that allowance can be totally tax-free. To make that happen, you can switch to a Tax-Free Car Allowance (TFCA) program that follows the rules laid out in IRS Publication 463.

Start by making sure the program is accountable. That means employees need to log their mileage with details like the business purpose and the start and end locations of each trip. This helps prove the driving was for work, not personal use.

Next, check that your reimbursements line up with the IRS standard mileage rate (72.5 cents per mile for 2026). If you pay more than that, the extra amount is taxable. But if you stay at or below the rate and keep proper records, both you and your employees avoid unnecessary taxes.

The bottom line? Employers only pay tax on the portion of the allowance that exceeds the IRS rate. And for employees, that means their business-required driving costs can be covered tax-free, leaving more money where it belongs: in their wallets.

Alternatives to Car Allowances: Should You Switch in 2026?

If you’re still using a flat car allowance to reimburse employees in 2026, it might be time to ask: is there a better way?

One of the best IRS-compliant alternatives is the Fixed and Variable Rate reimbursement program (FAVR). Unlike a one-size-fits-all car allowance, FAVR adjusts based on two key things: the fixed costs of owning a car (like insurance, registration, and depreciation), and the incurred variable per-mile costs of actually using it (like gas, maintenance, and mileage).

This makes it much more accurate and fair, especially for employees who drive different amounts each month.

But here’s why more companies are making the switch: FAVR programs are 100% tax-free when structured properly. Rates are adjusted based on the cost of driving in an employee’s ZIP code ensuring payments are fair, data-driven, and 100% tax-free.

Employers don’t have to pay payroll taxes on the reimbursement, and employees get to keep the full amount, instead of losing 30% or more to taxes like they would with a flat allowance.

FAVR can also lead to serious cost savings. Companies that adopt it often see up to 30% reductions in vehicle reimbursement expenses compared to traditional car allowances. That’s because the reimbursement is tailored to actual usage, so low-mileage drivers aren’t overpaid, and high-mileage drivers aren’t left undercompensated.

Of course, there are requirements for running a compliant FAVR program. You need at least five drivers, and each one must log over 5,000 business miles per year. Their vehicles also need to meet certain cost and age thresholds, usually capped based on IRS rules.

But if your team meets those criteria, switching to FAVR in 2026 could be a smart move. It’s more accurate, more tax-efficient, and more aligned with how people actually drive for work. For many employers, it’s a long-overdue upgrade.

Switch to Tax-Free Reimbursements in 2026

In 2026, the cost of business driving will likely be higher than ever, and flat allowances often don’t keep up. Programs like TFCA and FAVR offer a smarter, more accurate way to support your team while reducing tax waste and admin load.

Switching from a flat car allowance to a more accurate, tax-efficient program like FAVR or TFCA doesn’t have to be complicated. In fact, many companies simplify the entire process by outsourcing to a vehicle mileage reimbursement provider like Cardata.

Instead of building the program from scratch, Cardata handles the heavy lifting, like mileage tracking, insurance verification, tax compliance, and reporting. That means your teams don’t have to get bogged down in admin work, and your employee drivers get a seamless experience with reimbursements that reflect their actual costs.

Whether you’re ready to move to a full FAVR program or just want to make your car allowance tax-free, working with a partner like Cardata can make the transition smoother, faster, and more cost-effective.

Ready to embrace a mileage reimbursement program? Connect with Cardata’s experts to see which program will benefit your organization and drivers most.

Share on: