Team Cardata

4 mins

Cut Fleet Costs by 30% with Mileage Reimbursement Software

Corporate fleets face mounting pressure from rising costs, tax complexity, and evolving compliance requirements. In response, many organizations are turning to mileage reimbursement software as a cost-control tool, and as a strategic upgrade. By automating mileage tracking and aligning reimbursements with IRS and state labor rules, these platforms streamline administration, reduce risk exposure, and unlock […]

Speak to an Expert

Book a CallCorporate fleets face mounting pressure from rising costs, tax complexity, and evolving compliance requirements. In response, many organizations are turning to mileage reimbursement software as a cost-control tool, and as a strategic upgrade.

By automating mileage tracking and aligning reimbursements with IRS and state labor rules, these platforms streamline administration, reduce risk exposure, and unlock significant financial savings, all while improving the experience for drivers and back-office teams alike.

Why The Shift To Reimbursement

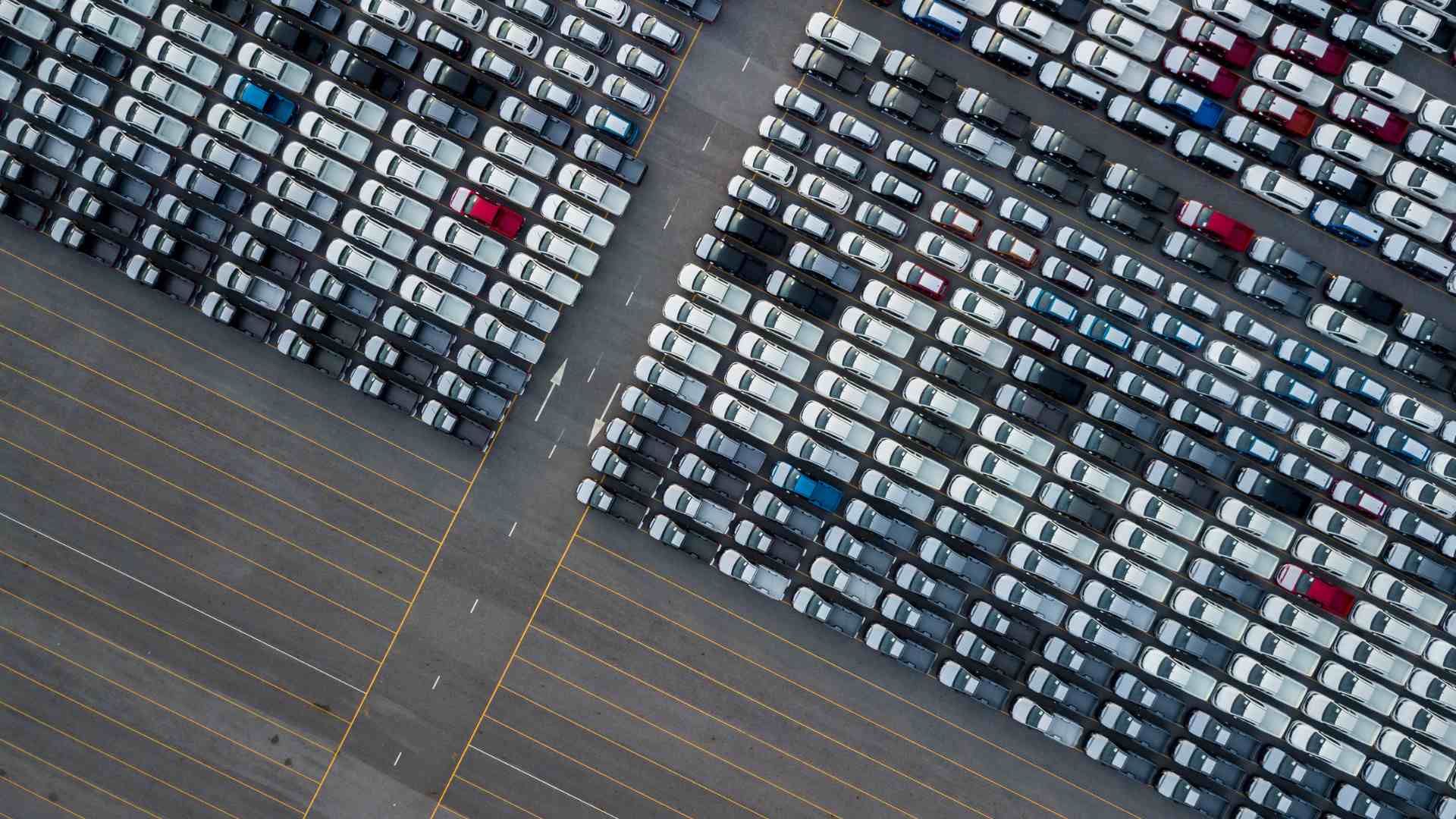

Company fleets once signified stability, yet rising vehicle prices, insurance premiums, and tax exposure have turned them into cash drains.

Mileage reimbursement platforms solve that problem by replacing unnecessary, depreciating physical assets with software that automates every step of tracking, validating, and paying for business travel in employees’ personal cars.

Because these programs fall under the IRS accountable plan rules, properly documented payments are non-taxable, instantly trimming about 30% from payroll costs compared with taxable car allowances.

How The Technology Works

Modern mileage reimbursement tools, exemplified by Cardata, live both in the cloud and on a driver’s phone. A low-distraction GPS mobile app launches automatically, distinguishes business from personal travel, and records odometer readings so that every mile can survive an IRS audit initiated months or even years later.

That automation eliminates manual logbooks and hands back roughly 42 hours of administrative time to each driver annually. On the back end, a Fixed and Variable Rate rate (FAVR) engine pulls current fuel, insurance and tax data for every zip code in the United States, then generates individualized reimbursements that mirror a driver’s real business required expenses while staying within federal thresholds for tax-free treatment.

Anomalies like duplicate claims, detours, or mileage spikes surface on supervisor dashboards for quick review, and once approved, payments flow through directly into employees’ bank accounts, giving finance teams real-time visibility into spend without additional labour.

Why It Is Cheaper And Safer Than Company Cars

Replacing select underutilized or non-specialized fleet vehicles with accountable reimbursements can save about $3,000 per driver each year, and because the software also automates reporting, companies reclaim close to 4,000 administrative hours for every hundred drivers.

Risk declines in parallel: when employees use their own cars, their personal auto policies serve as the primary layer of liability, avoiding commercial auto premiums that often run twice as high. Environmental and operational gains follow as well.

Because drivers naturally favor newer, fuel-efficient cars, frequently hybrids or EVs, companies see annual maintenance costs drop by roughly $1,200 per vehicle and report lower fuel spend in 55 percent of cases, all while shrinking their carbon footprint.

Compliance And Implementation

Staying at or below the IRS standard mileage rate of 70 cents per mile in 2025 keeps reimbursements tax-free, yet FAVR programs can legally exceed that figure if they document actual costs and respect the agency’s 5,000 mile and vehicle value thresholds.

Software automatically applies those rules while also enforcing state labor codes such as California’s §2802 and Illinois’s Wage Payment and Collection Act, both of which obligate employers to cover necessary business expenses.

To roll out a program smoothly, Finance, HR, and fleet managers collaborate on rate settings to balance fairness with budget discipline, and drivers receive concise training on app usage, insurance minimums, and documentation.

Many firms outsource administration because the subscription typically costs half of a full-time HR salary while adding expertise that keeps audits clean.

Choosing A Provider

Any shortlisted platform should demonstrate airtight IRS compliance, accurate GPS capture that does not distract drivers, and responsive human support.

Cardata, for example, answers 80 percent of calls in under two minutes, a metric that prevents minor driver questions from snowballing into lost productivity.

Mileage reimbursement software turns vehicles from fixed corporate liabilities into variable, fully documented, and tax-efficient expenses that favor both the balance sheet and the driver experience.

To see how much your company could save, connect with Cardata’s reimbursement specialists and receive a customized cost-benefit analysis.

Share on: