Torben Robertson

15 mins

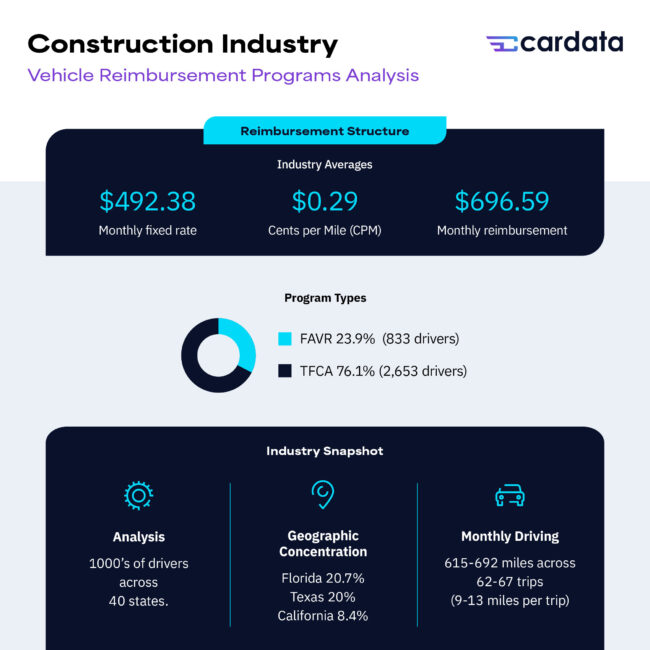

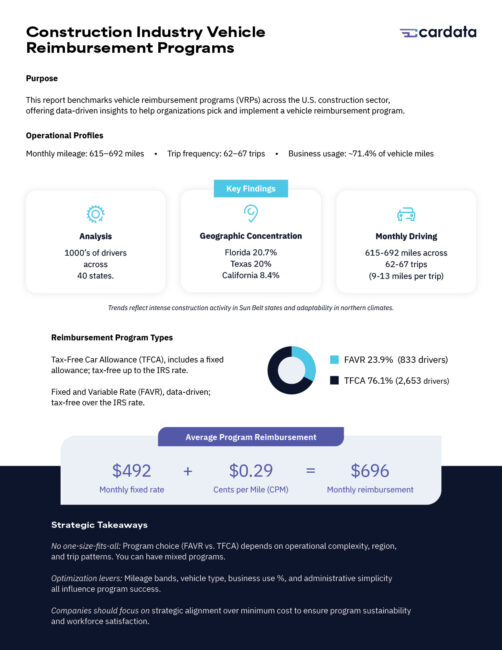

Construction Industry Vehicle Reimbursement Programs Analysis

Speak to an Expert

Book a CallIntroduction

This report is intended to provide benchmarking data to construction industry companies wishing to implement a vehicle reimbursement program, for employee drivers who use personal vehicles for work. It will show different levers construction companies can pull to adjust their program to their financial and operational goals.

The companies analyzed in this study have all prioritized compliance in the design of their vehicle reimbursement programs. (Compliance with IRS guidelines for vehicle reimbursement guarantees the tax-free status of reimbursement payments issued to drivers.) They have prioritized building programs for the purpose of tax compliance and appropriate coverage without overages. However, many reimbursement options exist in the marketplace, and companies can consult with a VRP provider to design programs based on their desired outcomes. Comments about program design can be found throughout this report.

Executive Summary

This analysis examines vehicle reimbursement programs across the construction industry, spanning operations in 40 states with significant concentrations in Florida, Texas, and California. Companies employ two primary reimbursement methodologies: Fixed and Variable Rate (FAVR) programs and Tax-Free Car Allowance (TFCA; IRS 463 Accountable Allowance) programs. Both approaches combine fixed monthly allowances with variable per-mile reimbursement rates to address diverse operational costs. FAVR programs typically offer more detailed cost tracking and localized adjustments, while TFCA programs provide simplified administration while maintaining tax advantages. Companies adapt their reimbursement structures based on their service territories and operational patterns, with monthly fixed allowances averaging $492 and per-mile rates clustering around $0.29.

Analysis reveals that companies tailor their vehicle programs to specific regional factors, including fuel costs, maintenance expenses, and insurance variations while maintaining average monthly mileage between 615-692 miles across approximately 62-67 trips. These program design choices reflect underlying business models and market coverage strategies, with companies balancing administrative simplicity against the need for precise cost accounting.

Industry Snapshot

We analyzed 3,486 drivers across 40 states who use vehicle reimbursement programs, representing a significant mobile workforce with distinct operational patterns and needs. When viewed as a whole, industry averages reveal important patterns in how construction companies structure their vehicle programs.

This industry overview provides context for understanding construction sector vehicle reimbursement programs, highlighting the typical patterns and standards that characterize the market. Combined with the detailed comparative analysis found in Section 2, it offers a comprehensive view of how individual companies may deviate from or align with industry norms.

Our analysis is based on reimbursement data from 2023 and after.

Section 1: Industry-Wide Metrics

We analyzed 3,486 construction industry drivers across 40 states who use vehicle reimbursement programs. The programs are unevenly split between two methods: Fixed and Variable Rate (FAVR) programs and Tax-Free Car Allowance (TFCA) programs.

Distribution of Reimbursement Programs

The majority of drivers, 76.1% (or 2,653 individuals), participate in TFCA programs. These programs are favored for their simplicity and tax advantages, requiring minimal administrative overhead while maintaining compliance with IRS guidelines. FAVR programs account for 23.9% (or 833 drivers) of the total. Although less common, FAVR programs are prized for their precision in cost tracking and ability to adapt to local economic factors like fuel prices and insurance rates.

Types of Vehicle Reimbursement Programs

- Fixed and Variable Rate (FAVR) Programs

FAVR programs blend fixed monthly allowances with per-mile variable reimbursements, providing a highly detailed and localized approach to covering vehicle expenses. These programs require meticulous record-keeping to ensure compliance and accurately reflect regional variations in costs like fuel, maintenance, and depreciation. While administratively intensive, FAVR offers unparalleled precision, making it an ideal choice for companies operating across diverse geographies. - Tax-Free Car Allowance (TFCA) Programs

TFCA programs provide tax-free reimbursement as long as payments remain below the IRS mileage rate (67 cents per mile in 2024) and drivers document the business purpose and mileage of each trip. TFCA programs are easier to administer, requiring fewer resources to manage while still offering significant tax benefits. This simplicity makes TFCA the preferred choice for many construction companies, particularly those with uniform operational patterns.

By leveraging these two types of vehicle reimbursement programs, construction companies tailor their approaches to meet the needs of their workforce while managing costs effectively.

Geographic Footprint

The construction industry’s vehicle reimbursement programs have a broad geographic reach, spanning operations in 40 states. While the workforce is widely distributed, certain states emerge as key hubs for these programs.

Regional Concentrations

The largest concentration of drivers is in Florida, home to 720 drivers, accounting for 20.7% of the total. Texas closely follows, with 697 drivers (20.0%). California represents 8.4% of drivers, with 293 participants.

Regional Insights

This distribution highlights a strong representation in the Sun Belt states, where year-round construction activity and extensive infrastructure development drive demand for vehicle reimbursement programs. Additionally, the construction sector maintains a presence in the upper Midwest, signalling its adaptability to varying climates and regional economic conditions.

Industry Standards

Table 1: Distances

| Operational Metrics | ||

| Industry Measure | Simple Average | Weighted Average* |

| Monthly Mileage | 615.82 | 691.98 |

| Monthly Trips | 66.69 | 62.19 |

| Miles per Trip | 9.23 | 12.74 |

| *Weighted “Group A”/”Group B”—see Section 2 | ||

Table 2: Reimbursements

| Financial Metrics | ||

| Cost Component | Simple Average | Weighted Average* |

| CPM | $0.28 | $0.29 |

| Monthly Fixed Rate | $444.33 | $492.38 |

| Combined Monthly Reimbursement (CPM x Mileage + Fixed) | $621.93 | $696.59 |

Industry Characteristics

Vehicle Usage Patterns

- Trip Frequency and Distance

Construction drivers average 62 to 67 trips per month, with individual trips typically spanning 9 to 13 miles. This adds up to monthly mileage between 615 and 692 miles, translating to an annual mileage projection of approximately 7,390 to 8,304 miles. - Business Use Profile

On average, 71.4% of a vehicle’s mileage is used for business purposes, reflecting the high operational demands of the construction industry. Drivers commonly fall within the 10,000 to 15,000 miles annual mileage band, and while this number is higher than the actual mileage driven, different mileage bands may apply within any given company, however drivers with lower mileage bands are not discernible, though they still affect the average in our analysis.

Cost Structure

- Fixed Components

Monthly fixed allowances range from $444 to $492, designed to cover costs like insurance, registration, and standard vehicle depreciation. These fixed rates are adjusted regionally to account for differences in local market costs, including variations in insurance premiums and vehicle registration fees. - Variable Elements

The cents per mile (CPM) reimbursement rate is at $0.28 to $0.29, with adjustments based on regional factors like fuel prices and maintenance expenses. These variable elements ensure fair compensation while reflecting the real-world costs of vehicle operation in different geographic areas.

Program Design Considerations

Common Factors

- Vehicle Standards

Vehicles used in construction must align with specific operational needs. They require features that support construction site access and mixed terrain capabilities, like robust suspensions or all-wheel drive. Standard vehicle profiles may also need to account for local climate conditions—for instance, ensuring vehicles are equipped to handle snowy winters in northern regions. - Operational Requirements

Regular site visits and local or regional coverage demand vehicles capable of consistent, dependable use. With mixed urban and suburban operations, vehicles must perform well across varying traffic and terrain conditions. This high utilization means that employees can meet the industry’s regular demands for mobility and accessibility.

Cost Management

- Fixed Cost Controls

Managing fixed expenses is essential to keeping vehicle programs cost-effective. Companies often focus on vehicle retention cycles to maximize asset value while optimizing insurance and registration costs. Maintenance planning is also critical, ensuring vehicles remain reliable while minimizing long-term expenses. - Variable Cost Efficiency

Variable costs, like fuel and maintenance, require active management. Companies can lower fuel costs through route optimization and improve efficiency with regular service interval planning. Proactive maintenance scheduling means vehicles stay operational, reducing unexpected downtime and costly repairs.

Market Implications

Program Requirements

- Administration

Vehicle reimbursement programs work best when their administrative processes are simple and efficient. This includes having systems for tracking mileage, documenting business purposes, and reporting expenses, all to ensure everything is clear and compliant. Regular checks are also needed to meet IRS rules and keep the program running smoothly. - Support Infrastructure

Supporting drivers is a key part of making these programs successful. Many companies are adding safety programs to protect their employees and reduce risks. They’re also working with outside experts who specialize in vehicle reimbursement to make things easier to manage, stay compliant, and run more efficiently.

Industry Trends

- Program Evolution

Technology is changing how companies handle vehicle reimbursement. Better tracking tools and smarter cost management systems are making programs more accurate and reliable. At the same time, companies are building more flexible programs that can adapt to different needs based on where and how they operate. - Market Adaptation

To stay competitive, companies are adjusting their programs to fit local costs, like gas prices and insurance rates. They’re also considering things like weather conditions to make sure their programs and vehicles work well in different climates. On top of that, there’s a big focus on keeping drivers happy while still running operations as efficiently as possible.

Section 2: Market Segmentation

While averages are instructive, there is a lot of variation within the construction industry. This division reveals striking operational contrasts: many drivers are engaged in high-frequency, short-distance driving averaging 78 trips monthly at 6.4 miles per trip, while a smaller number of drivers operate fewer but longer trips, averaging 46 monthly trips at 19.1 miles per trip. These patterns translate to significant cost variations, with the minority of drivers showing 75% higher monthly reimbursements, reflecting their extended travel requirements and different regional coverage models. The majority of drivers favor TFCA programs, while the minority predominantly favor FAVR programs, highlighting fundamentally different approaches to managing vehicle costs and operations.

Group A

(2/3rds market share, nickname: “short trips”)

Group A is characterized by short trips, Southeastern state dominant presence, lower total mileage, and lower total reimbursement.

- Market Share: 68.9% (2,401 drivers)

- Program Strategy: Exclusively uses TFCA

- Geographic Presence: 24 states

- Key Markets: Florida (641 drivers), Texas (440 drivers), North Carolina (149 drivers)

Group B

(Smaller group, 1/3rd market share, nickname: “long trips.”)

Group B is characterized by longer and fewer trips, national presence, and higher mileage distances and reimbursements.

- Combined Market Share: 31.1% (1,085 drivers)

- Program Mix:

- FAVR: 76.8% (833 drivers)

- TFCA: 23.2% (252 drivers)

- Geographic Presence: 38 states

- Key Markets: Texas (257 drivers), California (173 drivers), Wisconsin (102 drivers)

Comparative Reimbursement Analysis

Table 3: Basic Cost Structure Comparison

| Basic Cost Structure Comparison | |||

| Metric | Group A | Group B | Difference |

| CPM | $0.27 | $0.30 | $0.03 |

| Monthly Fixed Rate | $370.54 | $614.22 | $243.68 |

| Monthly Reimbursement | $507.27 | $885.91 | $378.64 |

Analysis of Cost Structure Differences

CPM Differential ($0.03)

The cost per mile (CPM) is 11.1% higher for Group B companies, but the difference is relatively small. Geographic factors play a big role here. The leading company operates in lower-cost states like Texas, Florida, and North Carolina, while Group B companies are more active in higher-cost regions such as California and Wisconsin. This reflects regional variations in fuel prices, maintenance costs, and overall operating conditions.

Monthly Fixed Rate Gap ($243.68)

Group B companies have a much higher fixed monthly rate – 65.8% more than their competitors. This gap comes from differences in program design. Group B companies use different vehicle types, have varied retention cycles, and slightly lower business use percentages (70% vs. the industry average of 71.4%). They also face higher insurance and registration costs, especially in snowy regions, compared to states like Texas, Florida, and North Carolina, where vehicles face less environmental stress.

Total Monthly Reimbursement Variance ($378.64)

Overall, Group B companies’ total reimbursements are 74.7% higher. This is due to a combination of factors: higher fixed rates ($243.68 more), a slightly higher CPM ($0.03 more), and greater monthly mileage (885.09 miles vs. 498.87 miles). These differences suggest Group B companies operate under fundamentally different models, likely requiring higher-cost setups to meet their operational needs.

Table 4: Comprehensive Metrics Comparison

| Comprehensive Metrics Comparison | ||||

| Metric | Group A | Group B | Weighted Avg | Simple Avg |

| CPM | $0.27 | $0.30 | $0.29 | $0.28 |

| Monthly Fixed Rate | $370.54 | $614.22 | $492.38 | $444.33 |

| Monthly Trips | 77.99 | 46.39 | 62.19 | 66.69 |

| Monthly Mileage | 498.87 | 885.09 | 691.98 | 615.82 |

| Miles per Trip | 6.4 | 19.08 | 12.74 | 9.23 |

| Monthly Reimbursement | $507.27 | $885.91 | $696.59 | $621.93 |

The Group A operates below both industry averages across all metrics:

- CPM is $0.02 below weighted average and $0.01 below simple average

- Fixed rate is $121.84 below weighted average and $73.79 below simple average

- Total monthly reimbursement is $189.32 below weighted average and $114.66 below simple average

- While monthly trips are higher, both mileage and miles per trip are significantly lower than averages

Table 5: Simple vs. Weighted Average Analysis

| Simple vs. Weighted Average Analysis | |||

| Metric | Simple Avg | Weighted Avg | Difference |

| CPM | $0.28 | $0.29 | $0.01 |

| Monthly Fixed Rate | $444.33 | $492.38 | $48.05 |

| Monthly Trips | 66.69 | 62.19 | -4.5 |

| Monthly Mileage | 615.82 | 691.98 | 76.16 |

| Miles per Trip | 9.23 | 12.74 | 3.51 |

| Monthly Reimbursement | $621.93 | $696.59 | $74.66 |

Analysis of Average Variations

Program Cost Metrics

- CPM: A small difference of +$0.01 shows consistency in variable cost structures across companies, with geographic effects balanced by volume distribution.

- Monthly Fixed Rate: +$48.05, or 10.8% higher when weighted by the number of drivers, offers a clearer industry-wide view.

- Monthly Reimbursement: +$74.66, or 12% higher in the weighted average, reflects the combined impact of higher fixed rates and more miles driven. Group B companies tend to drive more, while the Group A designs programs to optimize costs.

Usage Pattern Metrics

- Monthly Trips: The weighted average is slightly lower (-4.50 trips), the only negative weighted difference.

- Monthly Mileage: A significant +76.16 miles (12.4% higher) in the weighted average reflects more driving overall.

- Miles per Trip: The weighted average is +3.51 miles higher (38% increase), indicating longer trips for companies with larger driver pools.

Key Comparative Insights

Group A vs. Averages

- CPM: $0.02 below the weighted average and $0.01 below the simple average.

- Fixed Rate: $121.84 below the weighted average and $73.79 below the simple average.

- Total Monthly Reimbursement: $189.32 below the weighted average and $114.66 below the simple average.

- While the Group A records more monthly trips, their total mileage and miles per trip are significantly lower than industry averages.

Weighted vs. Simple Averages

- Reimbursement Rates and Mileage: Weighted averages are higher, highlighting how larger companies drive more miles and provide greater reimbursements.

- Monthly Trips: Only this metric is lower in the weighted average, indicating that smaller companies typically report higher trip frequencies.

- The Group A’s approach deviates significantly, optimizing costs at the expense of higher trip counts and lower mileage per trip.

Geographic Impact on Variable Costs

The CPM variations between companies ($0.27 for Group A vs. $0.30 for Group B) can be partially attributed to the geographic distribution of drivers. The Group A’s key markets (Florida, Texas, and North Carolina) historically maintain lower fuel costs than to states with significant Group B company presence (particularly California and Wisconsin). This geographic advantage contributes to lower variable reimbursement rates.

Section 3: Program Design for Outcome Optimization

Program Strategy Divergence

The Group A uses a simple strategy, relying entirely on Tax-Free Car Allowance (TFCA). In contrast, Group B companies heavily favor FAVR programs, with 76.8% of their drivers on this model, reflecting different operational priorities.

Cost Structure Variations

Group B companies reimburse 74.7% more per month ($378.64 difference), which aligns with their longer trip distances.

Usage Pattern Distinctions

- Group A: More frequent, shorter trips (78 trips/month, 6.4 miles per trip).

- Group B Companies: Fewer, longer trips (46 trips/month, 19.1 miles per trip).

This suggests the Group A focuses on smaller, localized operations, while Group B companies handle larger, regional projects.

Geographic Distribution

Most drivers are concentrated in Sun Belt states, with Texas (697), Florida (720), and California (293) leading in driver count.

Fixed Reimbursement Components

- Annual Mileage Bands

Fixed rates are tied to mileage ranges (e.g., 10-15k miles/year). The Group A operates within this band. - Business Use Percentage (BUP)

The industry standard for business use is 71.4%, but the Group A operates at 70%, slightly below average. - Vehicle Retention Cycle

Longer retention cycles reduce fixed reimbursements by spreading depreciation over more time. - Geographic Considerations

Costs like insurance, registration, and licensing vary by region and influence fixed reimbursements. - Standard Vehicle Profile

Common vehicle choices, like a Toyota Corolla or Ford F150, impact costs based on purchase price, depreciation, fuel efficiency, and insurance.

The Group A’s lower fixed reimbursement rate ($370.54 vs. $614.22) shows how these elements are carefully adjusted to reduce costs while keeping the program effective.

Strategic Implications

Business Model Impact

- The Group A operates in urban and suburban areas with a higher density of job sites, enabling shorter, more frequent trips.

- Group B companies focus on regional and rural coverage, with operations spread across more dispersed and distant job sites.

Cost Management

- The Group A achieves lower reimbursement rates through strategic program design and a presence in lower-cost regions.

- Group B companies’ higher reimbursement rates reflect the demands of extended travel distances and operations in higher-cost areas.

Market Positioning

- The Group A is optimized for high-volume, localized operations, emphasizing efficiency in densely populated areas.

- Group B companies are designed for broad geographic coverage, accommodating fewer but more distant job sites to meet their operational needs

Conclusion

The analysis reveals that successful vehicle reimbursement programs in the construction industry can be structured differently to achieve specific business objectives. Companies can leverage various program elements—including reimbursement methodology (FAVR vs. TFCA), geographic distribution, vehicle standards, and operational patterns—to align with their unique business models.

- Key program design levers include:

- Choice of reimbursement methodology, balancing administrative complexity against precision

- Geographic concentration, which significantly impacts both fixed and variable costs

- Trip patterns, whether optimizing for high-frequency short trips or lower-frequency longer trips

- Vehicle standards and retention cycles

- Business use percentage targets

The stark contrasts observed between different operational models—particularly in monthly reimbursement amounts ($507 to $886), trip patterns (6.4 to 19.1 miles per trip), and program choice (FAVR vs. TFCA)—demonstrate that there is no one-size-fits-all solution for construction industry vehicle reimbursement. Instead, companies should evaluate their specific operational needs, geographic footprint, and cost objectives when designing their programs.

For construction companies implementing or revising their vehicle reimbursement programs, this analysis suggests focusing on alignment between program design and business strategy rather than simply pursuing the lowest possible reimbursement rates. The most effective programs will be those that balance cost efficiency with operational requirements while considering regional variations in both fixed and variable expenses.

Authors

Torben Robertson, Senior Manager

Lindi Mokgethe, Analyst

Zachary Zulauf, Specialist

Share on: