Zachary Zulauf

11 mins

How to Choose the Best Mileage Reimbursement Program for Your Business

Choosing the right mileage reimbursement program is about aligning employee driving needs and behavior with your company’s financial goals, operational requirements, and tax strategy.

There are several IRS-compliant options on the table, but not all are created equal. Some will save you money and boost fairness. Others may expose you to tax inefficiencies or fail to incentivize the right employee behaviors.

So how do you pick the right one? Let’s dive into how each mileage program works, who it’s best suited for, and what trade-offs you need to consider.

This blog will guide you through the critical variables, like mileage volume, role requirements, tax compliance, geographic cost differences, and business goals, so you can select or design a reimbursement strategy that fits your workforce and maximizes value.

3 Main Types of Reimbursement Programs

Before narrowing in on the right fit, it’s essential to understand the tax-free mileage reimbursement models that are available to you. Each is IRS-compliant when it’s structured correctly, but they do differ in application, complexity, and cost-efficiency.

1. Fixed and Variable Rate (FAVR)

FAVR programs reimburse employees using personal vehicles for business travel based on a combination of their business required fixed monthly costs (e.g., depreciation, insurance) and their incurred variable per-mile costs (e.g., fuel, maintenance). Rates are adjusted based on the cost of driving in an employee’s ZIP code ensuring payments are fair, data-driven, and 100% tax-free.

2. Cents Per Mile (CPM)

A CPM program reimburses drivers per business mile, often the IRS standard mileage rate—70 cents per mile in 2025.

3. Tax-Free Car Allowance (TFCA)

A Tax-Free Car Allowance, made possible by IRS Publication 463,is an IRS-compliant reimbursement method that lets you offer flexible fixed and variable rates to your employee drivers without the compliance constraints of other programs. Employees are simply measured for tax.

Are fleet vehicles a tax-free option?

When employees require specialized, upfitted, or branded vehicles for their roles, assigning company-owned fleet vehicles may be the best choice.

But it’s important to note that fleet vehicles are not a tax-free reimbursement program.

Fleet vehicles are company-owned or leased vehicles provided to employees, and personal use of these vehicles is generally treated as a taxable benefit.

In contrast, tax-free reimbursement programs like FAVR, TFCA, and CPM reimburse employees for business use of their personal vehicles under IRS-compliant accountable plans, allowing reimbursements to be tax-free when compliance requirements are met.

Why choose a tax-free mileage reimbursement program?

Leveraging a tax-free mileage reimbursement program can make a big difference for both employers and employees. For starters, when companies use IRS-compliant programs like FAVR, TFCA, or CPM, the reimbursements aren’t taxed. This means there’s no income or payroll tax hit, which is a win for everyone involved.

Employers also save significantly (often around 30% per driver each year) by steering clear of taxable allowances and the hefty costs of managing a fleet.

Beyond cost savings, these programs are more fair and more accurate. FAVR, for example, customizes payments based on required vehicle costs, local fuel prices, and how much an employee drives, so no one is overpaid or shortchanged.

They’re also designed with compliance in mind, requiring audit-ready mileage logs and insurance documentation, which helps reduce liability and audit risk. On top of that, automation tools take care of mileage tracking and reporting, cutting down on admin time and errors.

But perhaps most importantly, employees appreciate the transparency and fairness of these reimbursements. It makes them feel valued and fairly treated, which boosts morale and retention.

How to Choose the Best Mileage Reimbursement Program

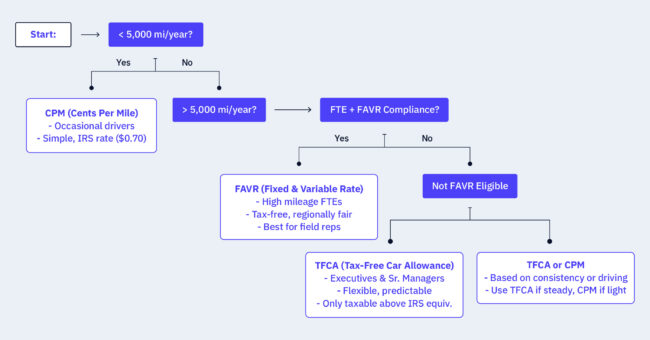

With the basics of these 3 tax-free programs in mind, let’s unpack how to evaluate the right program based on your workforce’s specific driving habits, job roles, compliance needs, and business objectives.

1. Start With Driving Behavior: Mileage Matters

The first question to ask is simple: how much are your employees driving for work?

High-Mileage Drivers

For high-mileage, full-time employees who drive for work, those clocking over 5,000 business miles per year, a FAVR program is usually the best fit.

FAVR is structured to reimburse both fixed costs (like depreciation and insurance) and variable costs (like fuel and maintenance) as two unique line items. It therefore doesn’t overpay for fixed costs as miles increase, and because it’s tailored to the driver’s geographic area and the vehicle required to accomplish their job (called a “vehicle profile”) , this reimbursement program works out to be fair and precise.

It’s also 100% tax-free when you meet IRS compliance requirements, which include maintaining at least five eligible drivers, each driving at least 5,000 business miles annually, and operating vehicles within price and age guidelines.

Lower-Mileage Drivers

For occasional employees logging less than 5,000 miles a year, the CPM reimbursement method can be a great fit.

This simple, low-admin model typically reimburses employees at the IRS standard mileage rate; any payment at or below this rate is tax-free when accompanied by compliant logs. CPM is ideal for departments with employees who travel infrequently or unpredictably.

Then there’s the TFCA, a more flexible model that combines a fixed monthly stipend with mileage tracking to reduce overall taxability. It’s useful when a FAVR program isn’t practical due to low mileage, but a CPM alone wouldn’t be substantial enough. It works well for executives and leadership who want predictability while still staying tax-compliant up to IRS limits, for example.

2. Consider Role Requirements: Function Over Form

Mileage alone doesn’t tell the full story. Sometimes the job itself demands a particular program structure.

If employees require specialized vehicles, like rigged trucks, cargo vans, or CDL-rated equipment, it often makes sense to use company-owned fleet vehicles. This is especially true when the vehicle is integral to service delivery or branding.

But when employees can complete their work using a standard personal vehicle, it’s worth considering a reimbursement model instead. These models shift the burden of vehicle ownership, maintenance, and insurance away from the company while still ensuring fair payment for business use.

3. Assess IRS Compliance and Risk Exposure

Your decision also has tax implications. The IRS sets strict standards on what constitutes a tax-free reimbursement. Programs like FAVR, TFCA and CPM are fully compliant when operated within the IRS framework.

But a taxable car allowance is subject to both income and payroll taxes, which typically leads to a 30% loss in value. This is because they’re often paid unsubstantiated by audit-proof mileage logs that prove the real business-use of a personal vehicle.

FAVR programs do require careful adherence to IRS rules, but the trade-off is that your organization and drivers receive unmatched accuracy and fairness. TFCA can serve as a compliant bridge when full FAVR implementation isn’t feasible. CPM, while simple, can result in over- or under-compensation if used for the wrong mileage tier.

Selecting the right program means balancing compliance complexity with financial outcomes.

4. Factor in Geographic and Economic Variables

Driving costs vary. Insurance rates, gas prices, and maintenance expenses are region-specific.

Imagine two sales reps: one working in rural Texas, the other navigating the busy streets of San Francisco.

The rep in Texas pays around $800 a year for car insurance, thanks to lower risks in their area. Meanwhile, the rep in San Francisco deals with steeper premiums, close to $1,500, because of local regulations and higher accident risks.

The difference doesn’t stop there. As of November 2025, gas in Texas is about $3.00 a gallon, but in San Francisco, it’s closer to $5.00. And with all the stop-and-go city traffic, the San Francisco rep also ends up paying more for maintenance due to added wear and tear.

For companies operating across multiple states or regions, a reimbursement program that doesn’t account for these differences will inevitably create winners and losers within your workforce.

But a tax-free mileage reimbursement program like FAVR takes these differences into account. It adjusts payments based on where each person drives, so both are reimbursed fairly for the actual costs they face.

TFCA or a tailored CPM plan with location-adjusted rates can also offer a viable middle ground. The key is to make sure that reimbursements align with actual costs. This way, you maintain fairness and avoid employee dissatisfaction.

5. Align with Business Goals and Budget

Every organization has unique goals. Some are focused on cutting costs, others want to lower tax liability, keep employees happy, or just make admin work easier. Each IRS-approved mileage program has its own pros and cons.

- FAVR gives you the most accurate reimbursements and tends to keep employees happiest, but it does take some effort to set up and manage, such as annual mileage band and vehicle profile adjustments. Using a transparent and expert reimbursement partner will help make FAVR simple in practice.

- CPM is super simple to run and easy to scale, though it might not be the fairest option if your drivers live in different locations and have differing mileage patterns. Not to mention the fact that, if used in the wrong scenario, CPM can encourage a drive-for-dollars mentality, which is why having an accountable mileage capture tool is integral for your program’s success.

- TFCA allows businesses to set or utilize any rates they desire, they are solely subject to the tax-test. This means that your reimbursement partner must compare the actual reimbursement amount to the IRS standard rate equivalent at their reported mileage band, only the overage is considered taxable. Despite the immense tax-advantage in a TFCA program, FAVR is the only method that allows businesses to pay over the IRS standard per-mile equivalent, making it the most tax-beneficial.

What really matters is being clear on what you’re trying to achieve. Running a cost-benefit analysis using real driver data can help you figure out which approach fits your company best.

6. Consider a Mixed Model Approach

The best solution won’t always be one-size-fits-all. Companies with diverse driver profiles often find that they benefit the most from using a combination of reimbursement methods.

For example, you might use FAVR for sales reps who drive a lot, CPM for field consultants with more occasional travel, and TFCA for senior managers. Mixing programs this way helps companies balance fairness with cost savings.

That said, it’s important to have clear communication, strong vehicle policies, and dependable tech in place to keep everything running smoothly and make changing employees between programs as easy as possible.

That’s where an expert reimbursement partner comes into play. Cardata is the end-to-end solution for modern reimbursements; including everything from program rate and policy design, to mileage capture and audit-proof logging tools, robust custom reporting and analytics tools, compliance verification, and direct driver payment so your people can be paid accurately, on-time, and tax-free.

Implementation and Transition Planning

Switching programs is both a financial decision, and a cultural one. Employees get used to certain ways of being reimbursed. Any change needs to be well-planned, clearly communicated, and supported with tools for mileage tracking, expense management, and compliance.

Start by modeling your current costs and testing reimbursement alternatives across various role types.

Then roll out the new mileage reimbursement program, with a focus on education and support. Educate your drivers on program benefits, compliance requirements, and how to use mileage capture tools. Offer driver and manager training, and responsive support to address questions and ensure smooth adoption.

Fit Beats Familiarity

When selecting a mileage reimbursement program, avoid defaulting to what’s easiest or most familiar. Remember: IRS-approved doesn’t mean universally effective.

The right fit depends on who your drivers are, what they drive, where they drive, and what your company wants to achieve.

In a tight labor market, offering fair, accurate, and tax-efficient vehicle reimbursement is more than a compliance issue, it’s a strategic advantage. Make your decision based on data, not inertia. And don’t be afraid to blend programs to get the best of each world.

Ready to embrace a mileage reimbursement program? Connect with Cardata’s experts to see which program will benefit your organization and drivers most.

Share on: