Follow us on LinkedIn

Our PageIntroduction

In this article, we dive into the IRS Publication 15-B 2022, Employer’s Tax Guide to Fringe Benefits, the literature that governs employee benefits such as a vehicle stipend or auto allowance.

We also explore the Internal Revenue Service’s definition of “fringe benefit,” why an auto allowance would qualify under this definition, and explain the different compensation structures the IRS permits for providing employees auto allowances.

What is an auto allowance?

An auto allowance is a common employee benefit offered by organizations to cover expenses related to using personal vehicles for work-related purposes. Basically, if your business doesn’t have a fleet of company cars, then odds are you ask your employees to use their own vehicles for work.

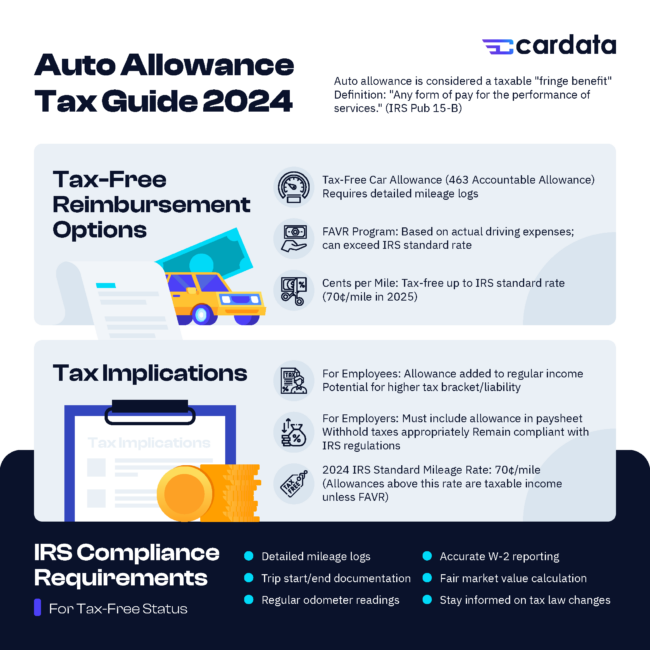

While it makes for a valuable perk, employers and employees alike should recognize that auto allowances are considered taxable by the Internal Revenue Service (IRS). That is, unless you implement some kind of record keeping and accountable allowance system.

For an auto allowance to be tax-free, both parties (driver and employer) are obligated to keep records of all trips logged for business purposes, including start and end destinations.The IRS may even require you to take regular odometer readings, depending on which reimbursement structure you offer your workers.

Why is an auto allowance taxable?

The reason an auto allowance, without accountability practices, is taxable as income is that it is considered a “fringe benefit” by the IRS, the definition for which is outlined clearly in Publication 15-B, Employer’s Tax Guide to Fringe Benefits, which states that “a fringe benefit is [any] form of pay for the performance of services.”[1]

This definition has clearly been made as broad as possible in order to cover the wide variety of possible activities that people do for work, and the equally-wide range of benefits employers offer to tempt people to work for them.

Publication 15-B also provides a list of common fringe benefits, schedules detailing which categories are and are not subject to taxation under the publication, and, crucially, a directive to employers that these fringe benefits must be calculated by January 31 of each prior year and be noted on employee’s pay and valuated at “fair market value”, or “the amount an employee would have to pay a third party in an arms-length transaction to buy or lease the benefit.”1

Auto allowances: a taxable fringe benefit

An auto allowance is considered a taxable fringe benefit because it is provided to employees in addition to their regular wages.

You or your boss provides a monthly stipend or annual lump sum as a benefit to reward you for fulfilling the obligations of your job, and since this is clearly a form of pay for the performance of services, it must be accounted to the IRS.

As such, auto allowances are subject to the same tax treatment as regular income is at the close of the financial year: it is taxed at or above certain income thresholds after all exemptions and deductions have been calculated.

Tax implications for employees

Employees who receive a payment for auto allowances need to be aware of the tax implications on their overall earnings. The auto allowance amount is added to their regular income, potentially pushing them into a higher tax bracket if they are near one of the thresholds (or if they live in an area with a higher cost of living, like NYC or California, and therefore likely have a higher car payment).

Consequently, this could result in a higher tax liability and an overall reduction in their take-home pay. No one enjoys getting a new perk at work or even a raise but then discovering they owe more in taxes than they did the year prior. If your auto allowance isn’t placed into a tax-free vehicle reimbursement program, your employees could be upset at tax time.

Employees should be briefed when any change to their compensation structures are made, or when they’re onboarded, in the case of new employees. Drivers who are aware of the definitions and limitations of their fringe benefits can best maximize their use while also reducing their overall tax burden.

Tax implications for employers

For employers, providing auto allowances requires strict adherence to a variety of accounting practices, outlined in the public literature provided by the Internal Revenue Service.

The amount of the auto allowance provided should be included in the employee’s paysheet as part of their income, whether given as a lump sum of cash, a monthly stipend, or other equivalent. The IRS wants all such methods of distributing auto allowances to be recorded and reported at fair market value.

Employers are also responsible for withholding the appropriate federal and state income taxes from the employee’s pay.

Strategies for mitigating tax

While auto allowances are taxable, employers can reduce the tax paid by employees by providing one of the following compensation structures:

- 463 Accountable Plan: Employers establish an accountable plan for auto allowances, which allows for tax-free reimbursements. To qualify, the employee must preserve and furnish their employer with detailed records of their business-related driving expenses, including mileage logs, receipts, or other relevant documentation.[2]

- Fixed and Variable Rate (FAVR) Program: Employers can adopt the IRS-designed FAVR program, which provides tax-free reimbursements based on actual driving expenses, including local fuel cost and the average new vehicle purchase cost for the region. The FAVR program requires meticulous record-keeping but can offer significant tax savings for employees, which makes them a popular alternative to taxable auto allowances. FAVR has its own system of compliance measures for taxation that employers must be familiar with in order to design a program.

Compliance with the IRS

To avoid tax issues and penalties, both employers and employees should prioritize compliance with IRS regulations, especially those outlined in the article above and in Publication 15-B. This includes accurate reporting of auto allowances on W-2 forms, proper withholding of taxes, and adherence to documentation requirements for accountable plans or FAVR programs.

Another important rule of thumb to keep in mind is that no matter which form of auto allowance you provide, the total payments made cannot be higher than the federal standard mileage rate, which for 2023 was 65.5 cents per mile driven for business purposes. (However, FAVR is the only program that allows allowances to be higher than this rate!) Any amount provided above this rate will be taxed as income. But as long as the IRS requirements for good record-keeping are met, auto allowances with cents per mile rates up to 65.5 cents can be provided without fear of an extra bill.

Conclusion

Auto allowances are a simple and convenient method for covering expenses your employees might incur while performing the regular duties of their employment.

However, choosing a structured and tax-free auto allowance is crucial to ensure your business remains competitive on both a fiscal and employee retention dimension.

Understanding why the IRS considers auto allowances taxable fringe benefits is need-to-know info when making financial decisions for the upcoming quarter and the next fiscal year.

Employees should be mindful of the potential impact on their take-home pay, while employers need to remain mindful of their duties to report, withhold pay, and educate their employees on the fringe benefits they provide and how those come into play when reporting personal income tax each year. Employers may also explore accountable plans or the FAVR program as tax-saving strategies.

By staying compliant with IRS regulations and exploring tax-efficient alternatives, both employers and employees can optimize the benefits of auto allowances while minimizing their tax liabilities.

Seeking guidance from tax professionals can provide valuable insights to ensure smooth implementation and adherence to tax laws. Cardata offers mobile mileage tracking software, powerful cloud storage, and tailor-made tax packages to help businesses lower their tax burden. Click here to speak to an expert.

Sources

[1] Publication 15-B (2023), Employer’s Tax Guide to Fringe Benefits | Internal Revenue Service

[2] Publication 463 (2022), Travel, Gift, and Car Expenses | Internal Revenue Service

Disclaimer: Nothing in this blog post is legal, accounting, or insurance advice. Consult your lawyer, accountant, or insurance agent, and do not rely on the information contained herein for any business or personal financial or legal decision-making. While we strive to be as reliable as possible, we are neither lawyers nor accountants or agents. For several citations of IRS publications on which we base our blog content ideas, please always consult this article: https://www.cardata.co/blog/irs-rules-for-mileage-reimbursements. For Cardata’s terms of service, go here: https://www.cardata.co/terms.

Share on: