Understanding Fleet Insurance Risks

Fleet management comes with a lot of insurance liabilities, costs, and administrative burden. Evaluate employee-owned vehicle reimbursements to distribute insurance risk.

Fleet insurance risks

Your company liability doesn’t end at 5:00PM. As long as that vehicle is under your company’s name, your company is responsible.

Enforcing safe driving practices is difficult because once the vehicle leaves company property, its subject to all kinds of risk, not to mention, accidents that occur during employee personal use time contribute to increased insurance premiums and additional legal liabilities.

Companies can be held accountable for off-duty accidents involving their company vehicles, regardless of whether the employee was at fault. This potential liability arises from the perception that companies have the financial capability to cover damages, including both bodily injury and property damage.

To mitigate this risk, Vehicle Reimbursement Programs offer a solution by redirecting liability away from company-owned vehicles.

The average annual insurance premium for company-owned fleet vehicles is $1,186 per car and rising.

Managing licensing, registration, and other administrative tasks can be time-consuming and costly, leading to stalled reporting and increased expenses. Shifting maintenance and documentation responsibilities to employees can help reduce these burdens and lower overall costs.

Offloading fleet insurance costs and liability is a business win, and empowering employees to use vehicles of their choice is a win-win! Switch to Cardata’s FAVR today!

Introducing Vehicle Reimbursement Programs (VRPs)

Fair compensation

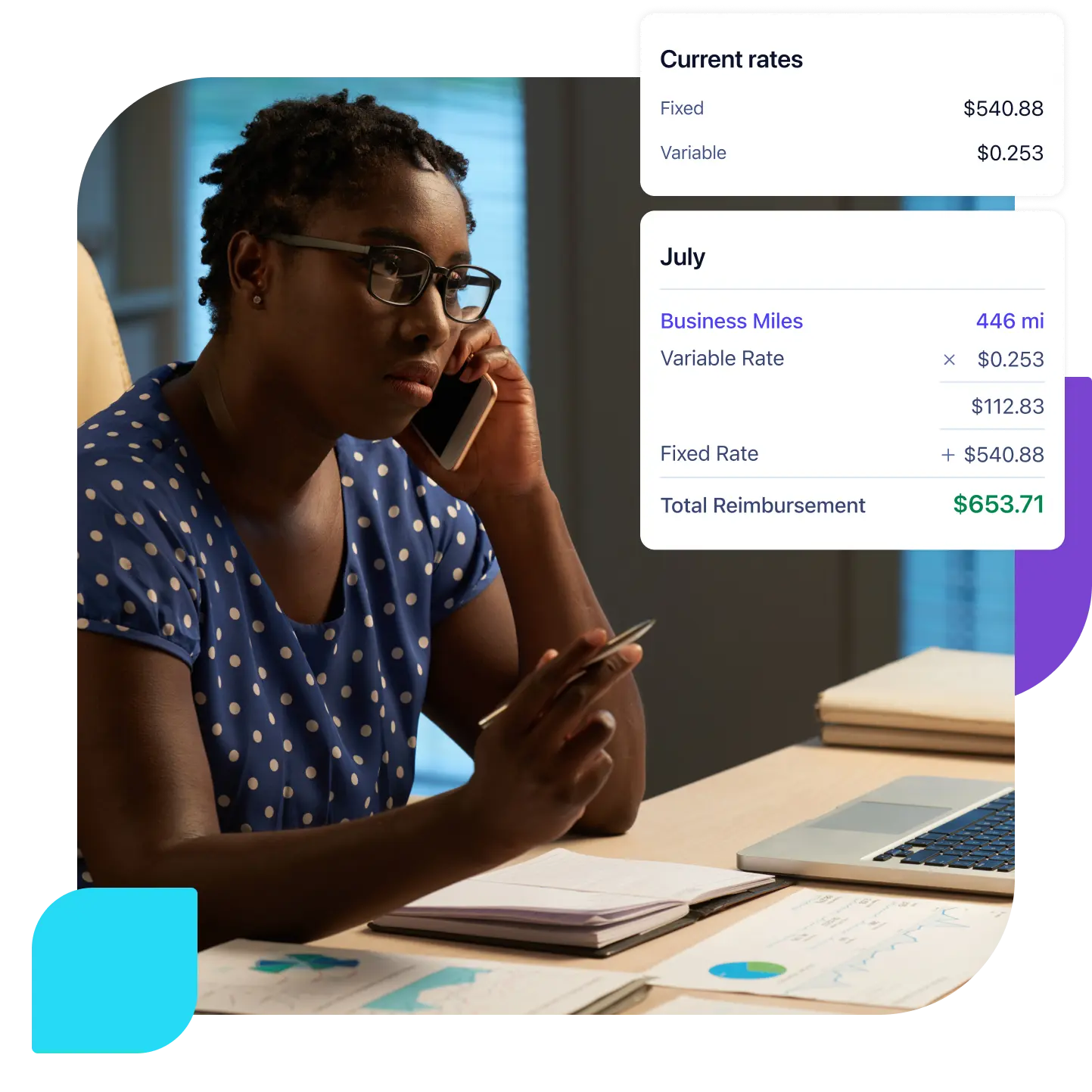

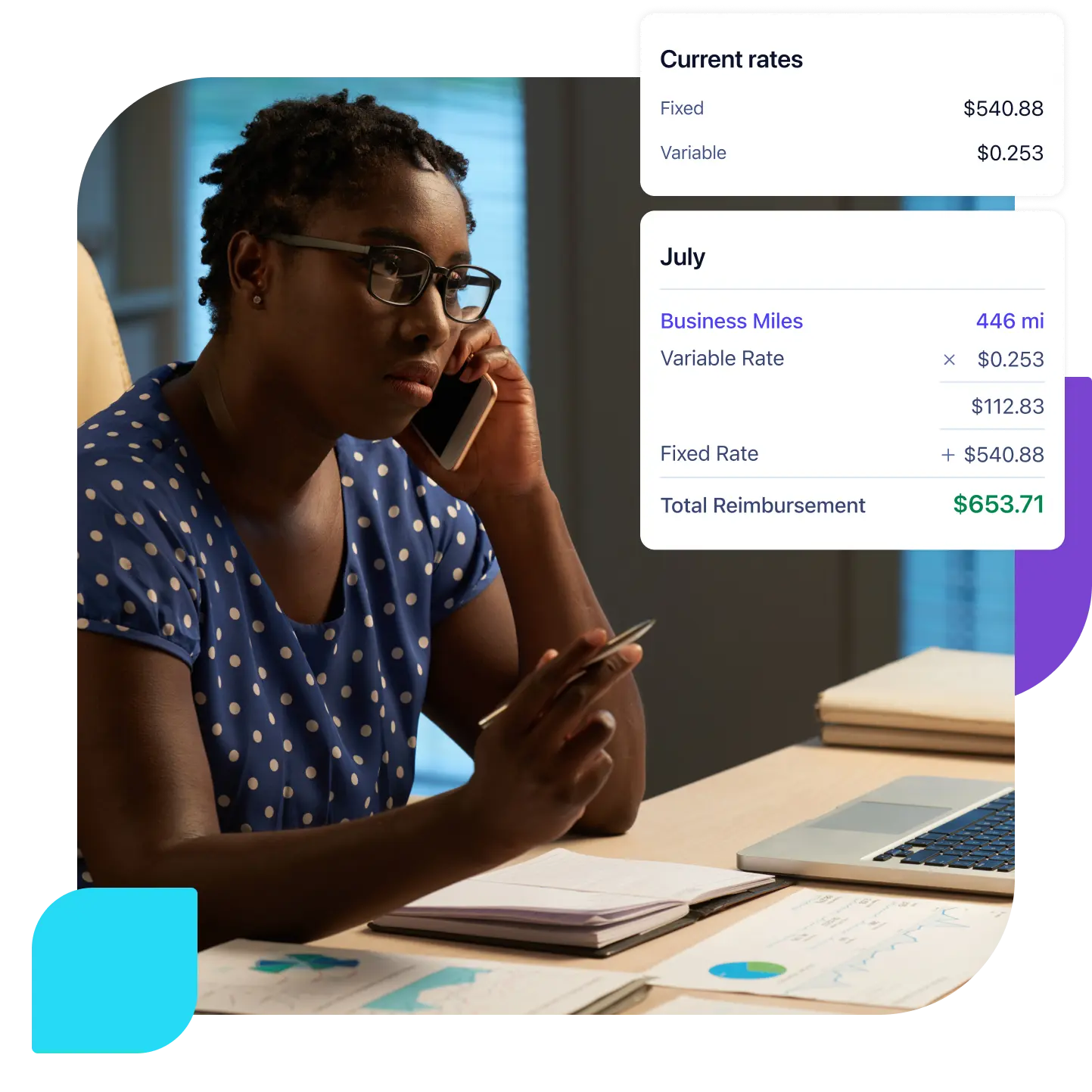

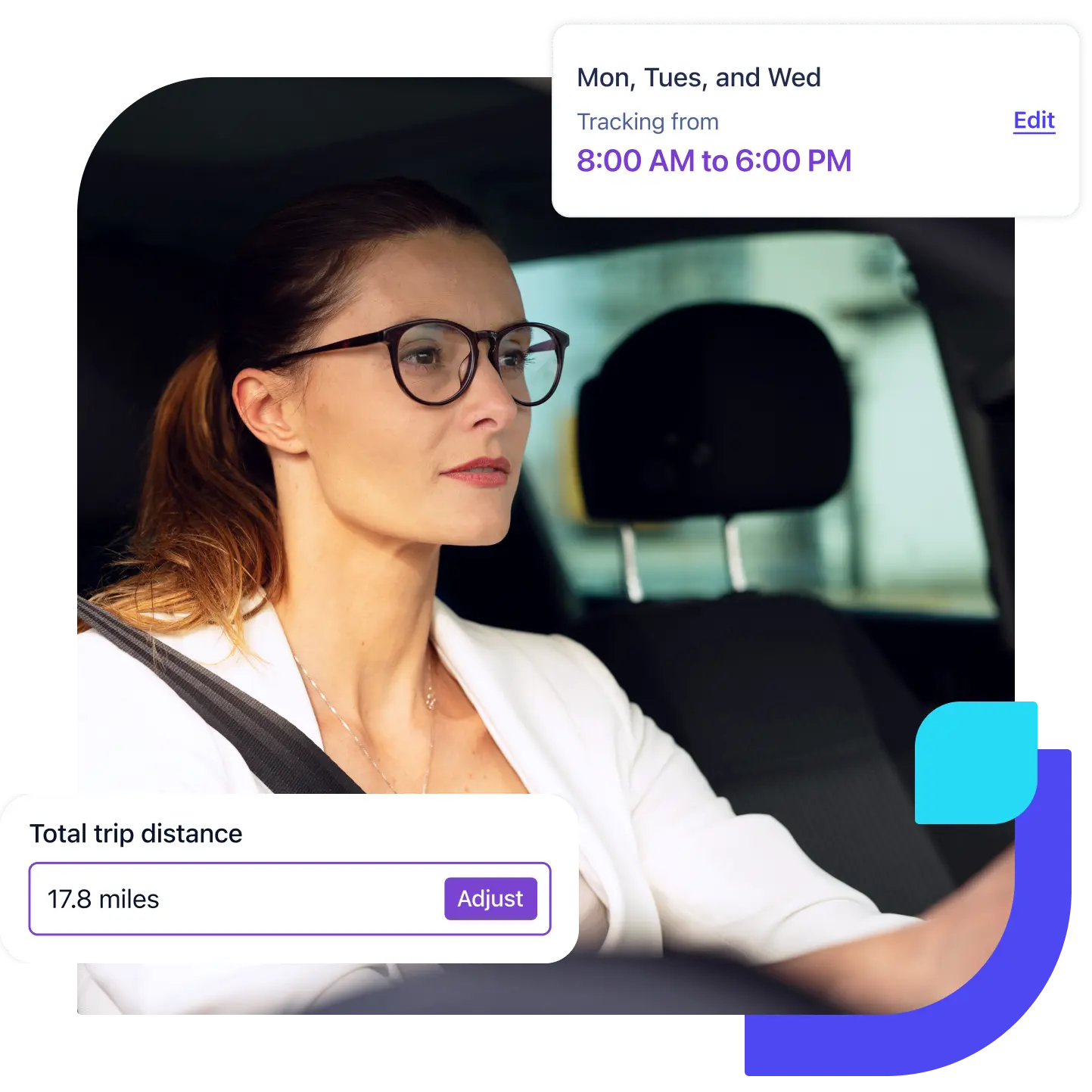

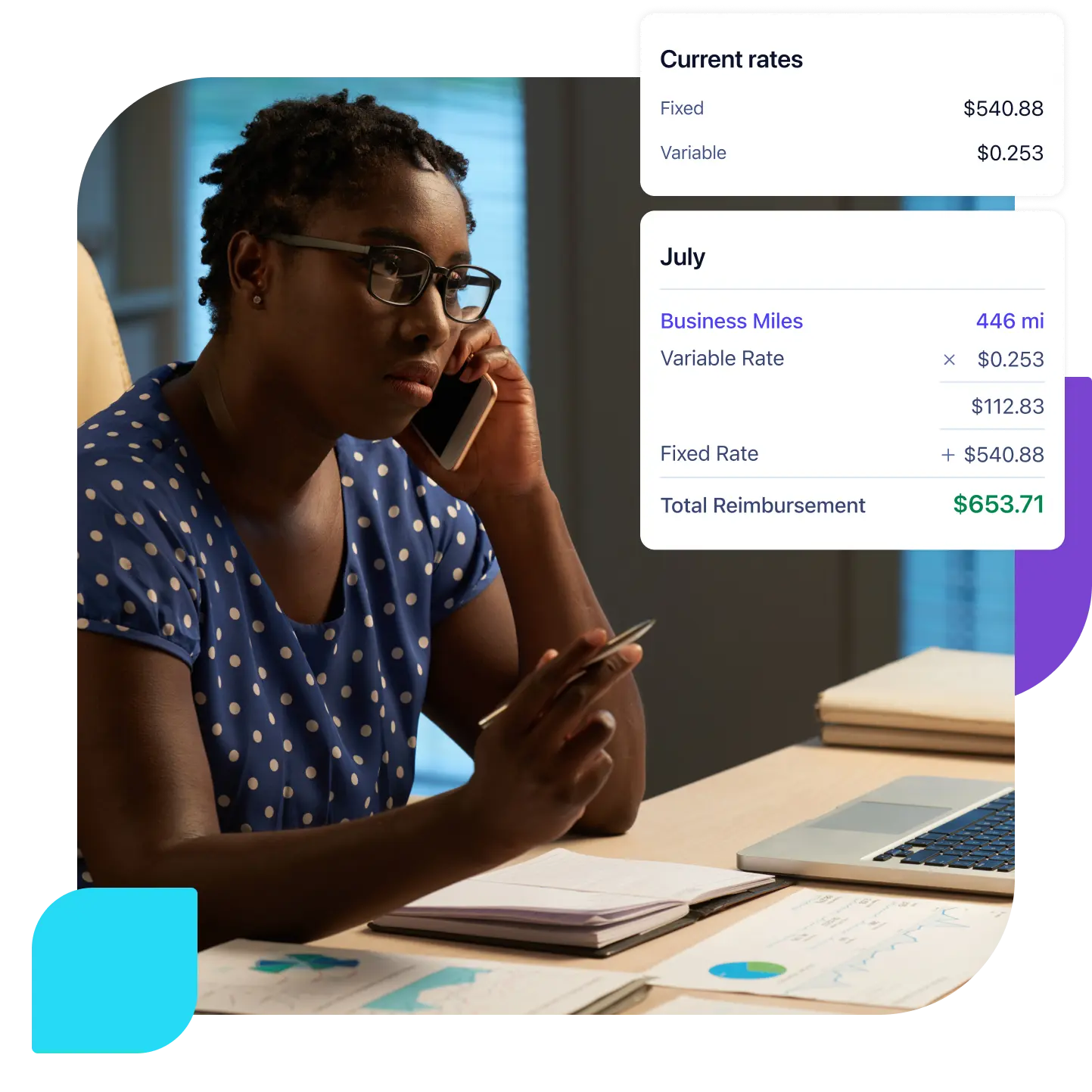

Cents per Mile (CPM) and FAVR guarantee fair compensation for business mileage, fixed costs, and variable expenses.

Accountable

VRPs offer accountable allowances, improving fleet safety and managing insurance premiums.

Reduce liability

VRPs transfer responsibility to employees' cars, reducing company liability and risk.

Reduce risk

Companies can avoid unwanted PR and litigation as a result of accidental property damage and bodily injury.

Benefits of VRPs

Cost efficiency

Your company’s bottom line won’t be hurt through personalized reimbursement reflecting actual usage, which can improve fleet management and risk management for commercial vehicles.

Empower drivers

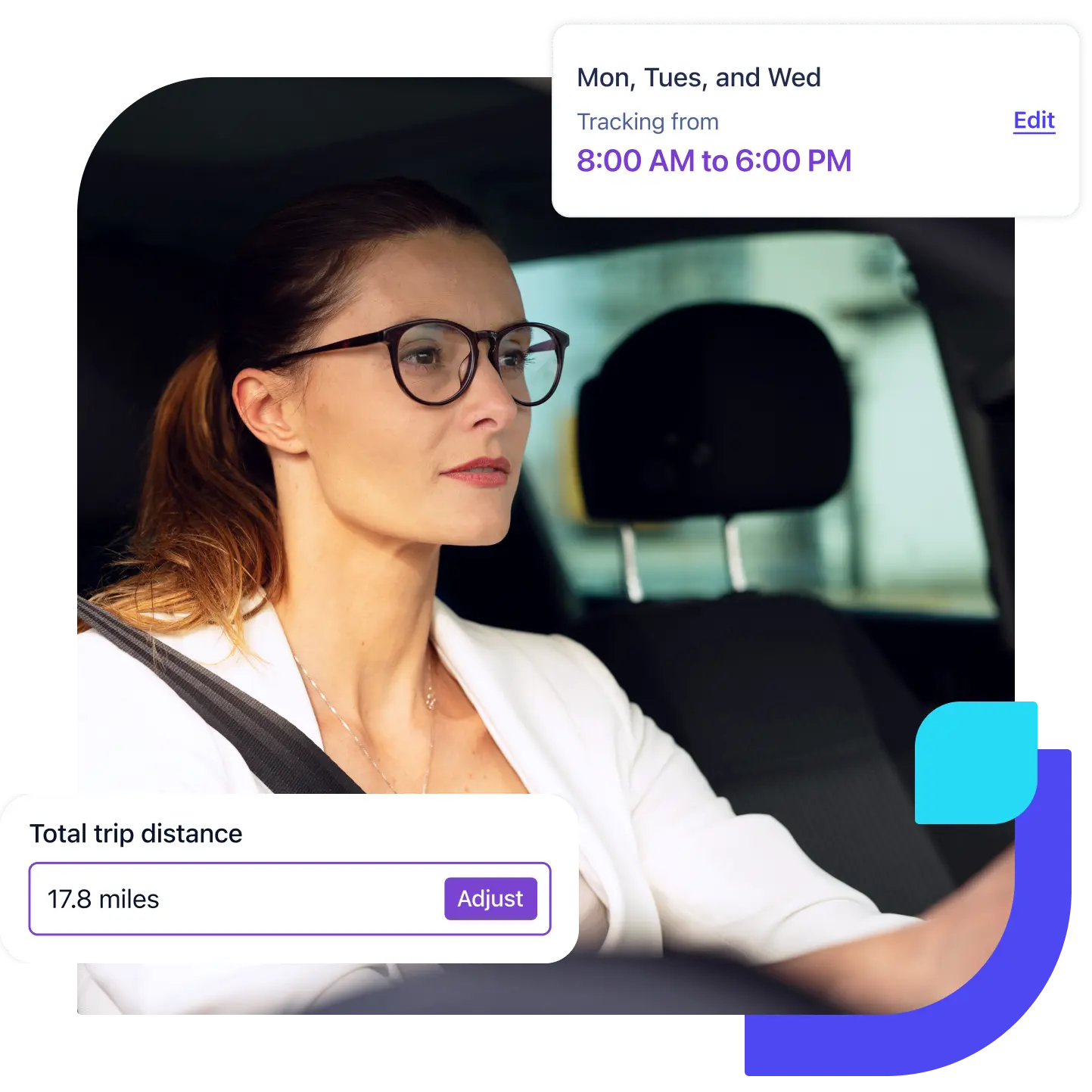

VRPs increase flexibility and employee satisfaction by allowing the choice of personal vehicles, promoting safe driving and fleet safety.

Ease administrative load

Simplified admin work frees up resources for other business tasks.

Boost efficiency

VRPs offer a practical alternative to company-owned fleets, mixing risk management and employee satisfaction while boosting fleet management and commercial fleet efficiency.

Ready when you are

Book a DemoMore reasons to modernize

Let Cardata guide your company through the transition away from traditional fleet management, empowering your company to thrive in a rapidly evolving market.