Follow us on LinkedIn

Our PageBusinesses across every industry rely on employees who use personal vehicles for work. And while there are many ways to reimburse those drivers, the most common method is the traditional “car allowance”.

On the surface, car allowances appear to be a simple method for covering driving costs for employees who are on the road.

You pick a monthly number, add it to payroll, and call it a day. But beneath that simplicity lie a number of financial inefficiencies, compliance risks, and fairness issues that most companies overlook.

This comprehensive guide brings together everything you need to know about car allowances: their hidden costs, tax treatment, how average rates are set, and what alternatives may serve your business better.

What is a Car Allowance?

A car allowance is a fixed monthly payment given to employees who use their personal vehicles for business-related driving. It is also commonly called a:

- vehicle allowance

- vehicle stipend

- car stipend

- lump-sum car payment

- auto stipend

Unlike mileage-based reimbursements, car allowances do not adjust based on the number of miles driven or actual vehicle costs. Every eligible employee receives the same consistent amount, regardless of how their costs differ.

This simplicity is why car allowances remain popular, but it’s also why they often fall short.

Car allowance vs. vehicle stipend vs. lump-sum allowances

These terms are often used interchangeably, but here’s the distinction:

- Car Allowance: A repeating monthly sum paid for business-related driving.

- Vehicle Stipend: A broader term that may apply to one-time or recurring payments for vehicle access.

- Lump-Sum Allowance: A one-time annual or quarterly payment.

No matter the structure, the tax treatment is usually the same: all are taxable unless part of a compliant accountable plan.

Can employers write off car allowances?

In most cases, employers cannot write off car allowances because the IRS treats them as taxable wages, not substantiated business expenses. They can only be written off if the business has detailed day-to-day receipts.

For an employer to deduct reimbursements tax-free, the payments must fall under an IRS compliant accountable plan, which requires mileage logs, proof of business use, and repayment or taxability of any excess amounts.

Traditional car allowances don’t meet these standards. They’re paid as flat sums with no documentation tying the payment to actual business driving.

As a result, they are classified as compensation, included in payroll, and subject to income tax and FICA. Because they aren’t linked to verified business expenses, employers cannot claim them as deductible reimbursements.

Instead, they’re treated the same way as salary, offering no tax advantage to the company.

Why Do Companies Use Car Allowances?

Companies lean on car allowances for one main reason: they’re simple. A car allowance is easy to budget, easy to administer, and easy for employees to understand. Instead of tracking mileage or managing complex reimbursement systems, employers can set a flat monthly amount and rely on payroll to distribute it.

This predictability appeals to HR, finance, and operations teams who want a straightforward way to reimburse employees for business use of their personal vehicles.

Car allowances also offer a sense of convenience for employees. Many drivers appreciate receiving a reliable amount every month, regardless of fluctuations in their actual expenses. That consistency can make financial planning easier, especially for roles that involve frequent travel.

Additionally, some organizations use car allowances because they’ve just always done things that way. Allowances often become a legacy practice that is passed down from a previous compensation structure or inherited from a competitor’s model, without ever being reassessed against current costs, tax rules, or fairness across the workforce.

Finally, car allowances can seem attractive when companies want to avoid the administrative requirements of more accurate programs, such as maintaining mileage logs, verifying insurance, or adjusting rates for geographic cost differences.

Allowances remove that burden, but often at the expense of tax efficiency, cost accuracy, and equity among drivers.

In short, companies use car allowances because they’re familiar and easy to run. But that simplicity often comes with hidden financial and compliance trade-offs that organizations only recognize once they evaluate the true costs of the program.

The Hidden Costs Behind Car Allowances

Many employers underestimate how expensive car allowances actually are. Here’s why:

1. Car allowances are almost always fully taxable.

Car allowances may seem simple, but they come with a major financial drawback: they are treated as taxable income under IRS rules.

The IRS taxes lump-sum car allowances as income, unless very special conditions are met.

Car allowances are subject to three taxes: Federal, state, and FICA. These taxes impact both the employer and employee, and amount to a total of almost 38%, which adds up, fast.

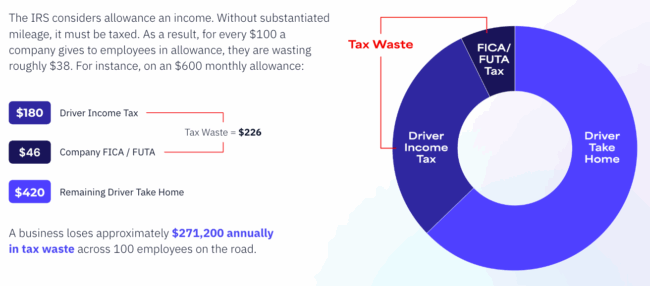

For example, when an employer provides a $600 monthly car allowance, the cost includes significant tax waste due to IRS rules.

- On a $600 allowance, approximately $180 is lost to driver income tax.

- The employer pays about $46 in FICA tax.

- Total tax waste is roughly $226.

This means that an employee receiving a $600 car allowance, will take home only $420. For 100 employees, this can mean $271,200 lost annually.

2. Car allowances rarely match real driving expenses.

Drivers’ costs vary widely, and a single flat car allowance can’t always reflect differences in local fuel prices, insurance rates, maintenance needs, depreciation, or the impact of driving in urban versus rural areas.

For example, fuel prices vary widely depending on where a business driver is located. Employees driving in states like California or New York often pay significantly more per gallon than those in the Midwest or South.

The end result is that some drivers receive more than they spend while others may find their allowance doesn’t fully cover their vehicle-related costs. These discrepancies can create challenges for both budgeting and ensuring consistency across the workforce.

The average car allowance has increased over time, but slowly. This is because many companies set their car allowance and forget about it, only updating the car allowance every few years.

3. They ignore wear and tear.

One of the biggest costs associated with driving a personal vehicle is depreciation. As soon as a vehicle leaves the dealership lot, it loses around 30% of its value right off the bat. For business drivers putting on thousands of miles a year, that depreciation hits even harder.

The more miles they drive, the faster the value of their car drops. For employees driving long distances every week, that wear and tear adds up quickly, not just in maintenance costs, but in how much the car is worth when it’s time for them to sell or trade in.

Car allowances do not scale with miles driven, leaving employees who drive more frequently bearing heavier financial burdens.

4. They fail compliance standards.

The IRS requires reimbursements to be substantiated, used strictly for business purposes, and adjusted when payments exceed actual expenses.

Flat allowances rarely meet these standards, which makes them compensation rather than a reimbursement. And that means they are taxable, and more susceptible to audit scrutiny.

Because stipends and fixed payments are treated as wages, they generate roughly 38% total tax waste, an area the IRS monitors closely.

Most car allowance programs also lack accountability measures, since payments aren’t tied to actual mileage or geographic cost differences. This can lead to overpayment or underpayment, both of which raise red flags during a review.

Without mileage tracking or proper documentation, car allowances simply aren’t audit-proof and leave companies exposed to compliance risks and potential penalties.

On top of these financial and compliance pitfalls, many allowances are flawed from the start because the rates themselves are rarely calculated with real accuracy.

5. Employer risks beyond IRS compliance.

Beyond tax waste and cost inefficiencies, traditional car allowances create several operational and legal risks that are often overlooked.

Insurance gaps are one of the most common issues. Most personal auto policies do not automatically cover business use, and employees might not purchase the necessary endorsements.

When a crash happens during work travel, the employer may be held financially responsible if the driver’s insurance denies or limits coverage.

Liability exposure also increases under a car allowance model. Flat stipends provide no visibility into whether employees maintain adequate insurance, safe driving habits, or roadworthy vehicles.

Without built-in oversight, companies have fewer controls to prevent avoidable incidents, making them more vulnerable to lawsuits, claims, and reputational damage.

Driver eligibility is another blind spot. Car allowances don’t require employers to verify whether drivers have valid licenses or concerning Motor Vehicle Record (MVR) histories.

A suspended license, recent DUI, or pattern of high-risk violations can dramatically elevate the organization’s risk profile without anyone realizing it.

Together, these gaps create a meaningful compliance and safety risk that flat allowances simply aren’t designed to address.

How Car Allowance Rates Are Determined

Most companies set their car allowances using a mix of practicality, precedent, and guesswork. On paper, a flat monthly payment to cover the cost of business driving sounds simple, but the way these amounts are determined can vary widely.

Typically, allowances are handled internally through payroll and paid out monthly, with the dollar amount based on factors like job role, territory size, or seniority.

A sales rep covering multiple states might receive a higher allowance than an employee who only drives locally, and some organizations adjust rates by region to account for differences in fuel, insurance, or operating costs.

But in many cases, these figures are still just rough estimates. Allowances are often set once and left untouched for years, even as vehicle expenses like insurance, maintenance, and fuel continue to rise. Employees feel that gap most acutely, especially when their actual costs outpace what the allowance covers.

Another challenge is that car allowances aren’t typically tied to real driving activity. There’s no mileage tracking, no verification, and no adjustment for how much (or how little) someone drives in a given month.

A flat payment may be convenient for employers, but it can be unfair in practice. A driver putting 3,000 miles on their car for business receives the same amount as someone driving 300 miles, despite having significantly higher expenses.

When Does a Car Allowance Make Sense?

Car allowances can make sense for companies where employees drive minimal or inconsistent mileage, or where operational simplicity outweighs the need for precise cost alignment.

For example, a small team of three might not find it practical or cost-effective to invest the time and resources needed to set up a mileage reimbursement program. In that scenario, a taxed car allowance, paired with manageable payroll remittances, may be perfectly suitable.

There’s no need for a startup to overhaul what’s working, though it’s worth keeping more sophisticated options in mind as operations grow.

On the other hand, large or distributed workforces often outgrow the limitations of a flat allowance. When some employees log significantly more miles than others, a single monthly payment quickly becomes inequitable and expensive.

A tax-free mileage reimbursement program aligns reimbursements to real-world driving patterns, which is especially valuable for organizations with field teams, logistical needs, or pharmaceutical reps on frequent client visits.

And in either situation, both options are typically more cost-effective than maintaining a fleet of company vehicles.

No matter the size of your workforce, there are a few core factors to consider when choosing the right program: employee driving habits, the tax implications of each reimbursement method, and the level of administrative oversight your team can realistically support.

Occasional business trips versus daily field travel will produce very different cost profiles. Understanding IRS-compliant options is essential, both for you and your employees, as is recognizing the operational lift of managing expense logs or mileage documentation at scale.

Smarter, Tax-Free Alternatives to Car Allowances

While car allowances can fit operationally, they’re rarely the most accurate or tax-efficient choice. After evaluating costs and risks, many businesses find that transitioning to an IRS-compliant vehicle reimbursement program brings significant advantages:

- Reimbursements that reflect real driving costs

- Complete tax efficiency for both employer and employee

- Stronger equity across teams

- Greater protection through proper insurance verification and driver eligibility checks

These programs also provide audit-ready documentation and help organizations forecast budgets more predictably year over year.

The most common alternatives to a car allowance are one of three tax-free vehicle mileage reimbursement programs: Fixed and Variable Rate programs, Cents per Mile programs, or Tax-Free Car Allowance models.

1. Fixed and Variable Rate (FAVR)

FAVR programs reimburse employees who are using personal vehicles for business travel based on a combination of their business required fixed monthly costs (ex., depreciation, insurance) and their incurred variable per-mile costs (ex., fuel, maintenance). Rates are adjusted based on the cost of driving in an employee’s ZIP code ensuring payments are fair, data-driven, and 100% tax-free.

2. Cents per Mile (CPM)

A CPM program reimburses drivers per business mile, often the IRS standard mileage rate—72.5 cents per mile in 2026.

3. Tax-Free Car Allowance (TFCA)

A Tax-Free Car Allowance, made possible by IRS Publication 463, is an IRS-compliant reimbursement method that lets you offer flexible fixed and variable rates to your employee drivers without the compliance constraints of other programs. Employees are simply measured for tax purposes.

Why Tax-Free, Compliant Mileage Programs Win

Across mileage reimbursement strategies, tax-free programs offer a range of advantages that make them more efficient and equitable than traditional allowances.

They generate meaningful payroll tax savings for employers while giving employees a larger take-home amount, and they align reimbursement more closely with real driving costs.

These programs also promote fairness across the workforce, reduce legal and compliance risk, and support clearer budgeting and forecasting.

In addition to the financial and administrative benefits, tax-free reimbursement models help maintain a safer, more reliable fleet by ensuring employees have the resources to properly care for their vehicles.

Fit Matters More Than Familiarity

Organizations often rely on car allowances because they’re familiar and easy to administer, but simplicity doesn’t always translate to efficiency. Traditional allowances can introduce unnecessary risk, tax waste, and financial inequity across a workforce.

The best vehicle program ultimately depends on your team’s driving patterns, geographic distribution, job responsibilities, compliance needs, and budgeting priorities.

When these factors are thoughtfully considered, a well-designed mileage reimbursement program becomes a competitive advantage that supports better hiring, retention, safety, and long-term cost control.

If you’re using a car allowance today, you’re likely losing money to tax waste and unnecessary risk. A compliant mileage reimbursement program can reduce costs, improve fairness, and protect your organization.

Talk to Cardata to see how much you could save, and how easy switching can be.

Share on: